Bank of America: Hedge funds are bracing for worse times and have above-average confidence in these 20 stocks (Part 1)

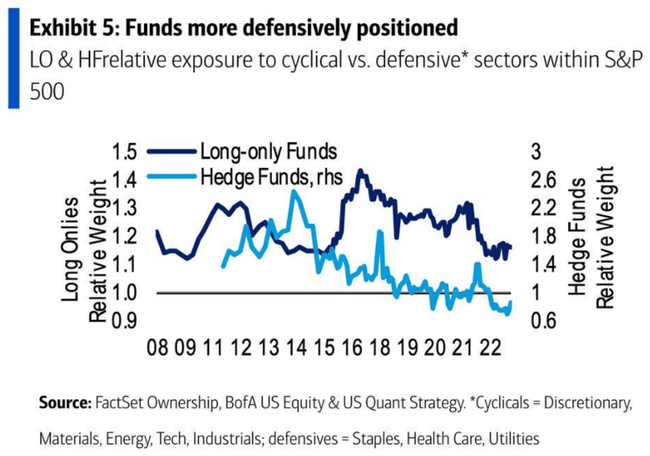

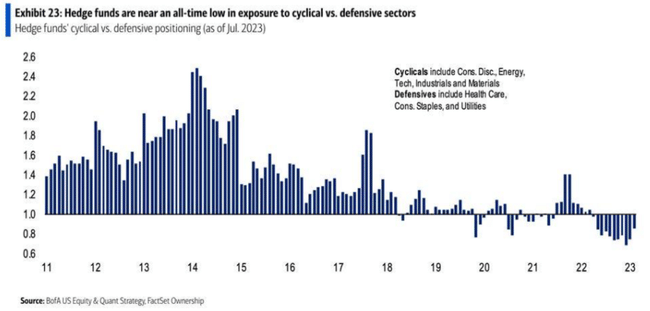

Although the data from the U.S. economy is fairly solid, hedge funds are not really overly optimistic. Defensive positions outweigh cyclical ones in the portfolios of funds that can bet on both LONG and SHORT. Which stocks do hedge managers trust the most in terms of the relative weighting of fund portfolios to benchmark indices?

The U.S. economy as a whole has performed well above expectations this year, driven in particular by a continuing tight labor market. Even GDP and personal consumption data have surprised positively this year, as has corporate capital spending. That is why analysts at Bank of America also updated their economic outlook in August, in which they no longer foresee a recession in the US in the baseline scenario. The August survey of large mutual fund managers was similarly positive, with fewer fund managers expecting a recession.

But surveys and outlooks are one thing; real investment decisions are another. Hedge fund and traditional mutual fund managers are preparing their portfolios for continued market and economic turbulence, according to data compiled by Bank of America. The composition of fund investments is thus heavily defensive.

Fund managers have shifted their portfolios in a more conservative direction in recent years, and this is only being confirmed today.

A defensive strategy may seem overly cautious in light of this year's equity strength, but some recent surveys of consumer and business sentiment have sounded relatively weak. Analysts at Bank of America have also warned of gradually slowing job creation, and therefore possible upward pressure on consumer spending. Last but not least, uncertainty persists about the Fed's future monetary policy, with its high rates only gradually feeding through to the real economy.

All of the above, however, does not mean that hedge funds should not bet on rising stock prices. On the contrary, they are currently 20% net LONG, which is near an all-time high. Only they are fishing more than average in the defensive segments of the market. Meanwhile, experts at Bank of America have compiled data on LONG and SHORT positions in individual titles in hedge fund portfolios and have pointed to twenty titles where LONG positions are most prevalent.

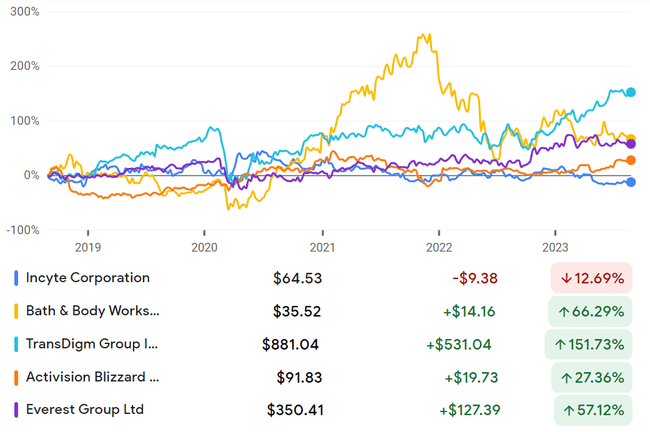

1. Incyte

Sector: healthcare

Difference in LONG and SHORT positions: 36.6%

2. Bath & Body Works

Sector: Residual consumer goods and services

Difference in LONG and SHORT positions: 28,3 %

3. TransDigm

Sector: industry

Difference in LONG and SHORT positions: 15,6 %

4. Activision Blizzard

Sector: Communication services

Difference in LONG and SHORT positions: 13,5 %

5. Everest Group

Sector: Finance

Difference in LONG and SHORT positions: 11.9%

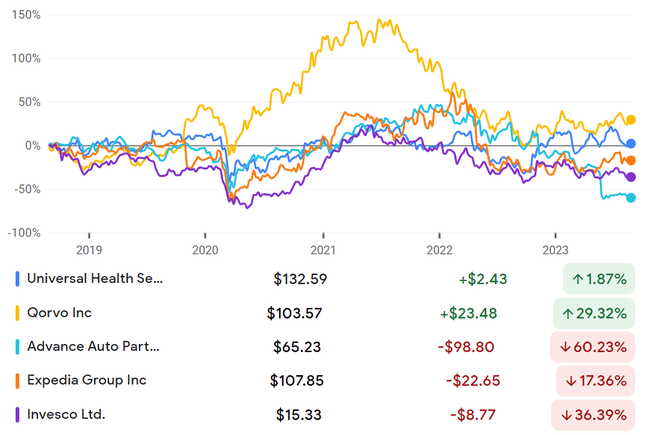

6. Universal Health Services

Sector: Healthcare

Difference in LONG and SHORT positions: 11.2%

7. Qorvo

Sector: Technology

Difference in LONG and SHORT positions: 10.9%

8. Advance Auto Parts

Sector: Residual consumer goods and services

Difference in LONG and SHORT positions: 10,9 %

9. Expedia

Sector: Consumer goods and services

Difference in LONG and SHORT positions: 10,9 %

10. Invesco

Sector: Finance

Difference in LONG and SHORT positions: 10.4%

Rest of tomorrow... :)

Well, nice charts, thanks! I know a few companies, but I'm not so sure about others. The recession is not the main issue now, so the markets are still rising. We'll see how it looks at the end of the year if we see a Santa Claus rally ;)