Real estate funds in 2023: Time to rest after last year's records

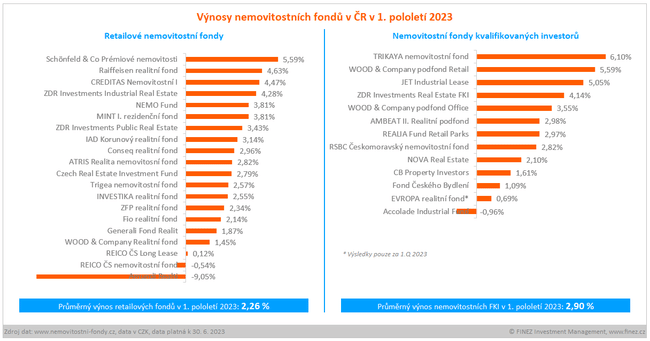

The average net return of real estate funds in the first half of the year reached 2.5%. None of the 33 real estate funds in the Czech Republic outperformed the inflation rate in the first half of this year, while three real estate funds posted losses.

The first half of this year was below average for real estate funds. The average return of real estate funds in the Czech Republic in the first half of the year was only 2.5%.

There are currently 33 real estate funds in the Czech Republic, primarily focused on property management and rental. The highest return in the first half of the year was achieved by the TRIKAYA real estate fund (6.1%), followed by the WOOD & Company Retail and Schönfeld & Co Premium Real Estate funds (both 5.59%). However, this was not enough to keep up with inflation in either case, as the value of the consumer price index in the Czech Republic has risen by 7.24% in 6 months since the end of 2022.

Three real estate funds even posted losses in the first half of the year. The Amundi Realti fund saw the biggest drop in the value of its units (-9.05%), while the Accolade Industrial fund (-0.96%), which is otherwise one of the best performing funds in history, recorded a smaller loss. And the value of REICO ČS Real Estate (-0.54%), the largest Czech real estate fund, fell slightly.

The year 2023 will be below average

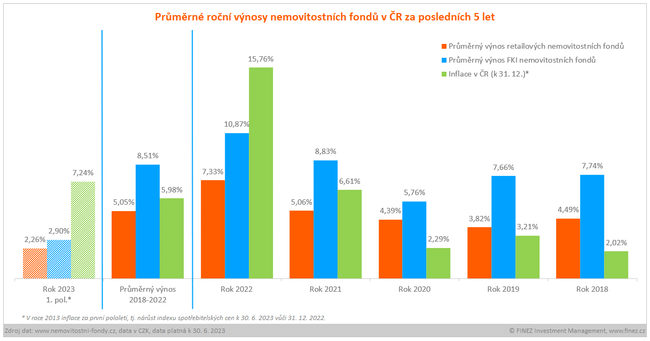

It is always premature to assess the results at half-time. For many funds, it is only at the end of the year that the revaluation of the value of the real estate under management becomes apparent, which of course moves the results quite a lot. For the time being, however, the results for the first half of the year suggest that 2023 will be a below-average year for real estate funds as a whole over the long term.

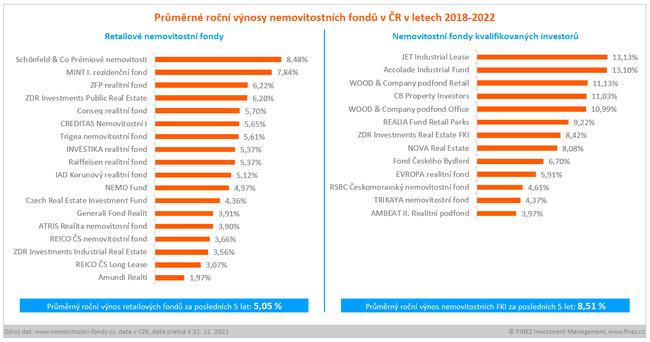

In 2022, most real estate funds in the Czech Republic reported record appreciation. The average net return for 2022 was 8.8%. Four real estate funds even managed to beat 15% inflation with their returns last year.

Over the long term, average returns for retail funds are around 4-6% per annum, and for qualified investor funds generally around 7-9% per annum. A number of real estate funds will reach or surpass these benchmarks this year as well. However, a number of funds will fall short of their benchmark this time. On average, I expect real estate fund returns to be weaker in 2023 than in the previous two years, with individual fund performance varying more widely than is usual.

Three major factors currently influence real estate fund valuations:

Rental yields continue to rise with inflation.

High interest rates are making loan repayments more expensive for funds.

A question mark hangs over property valuations, with yields ranging from 4.5% to 8% p.a.

Super summary!

Very nice comparison, thanks. You can clearly see here that if we have inflation this high and people don't invest themselves (where it's also hard), they won't get over it. It's too little risk and the return corresponds to that.