US stocks: will the year-end rally come? This argument weighs trillions of dollars

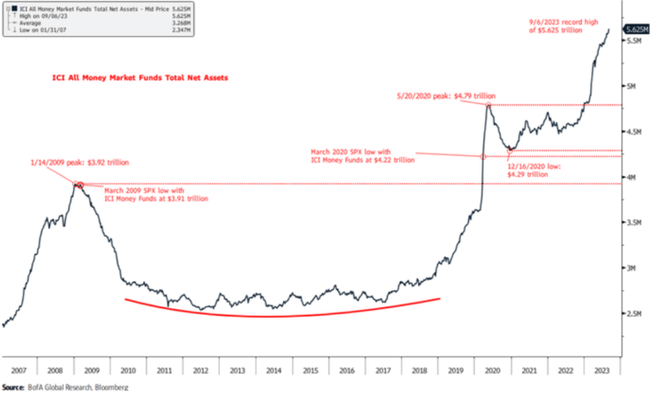

Something quite logical went hand in hand with the rise in rates and bond yields, and the inversion of the yield curve in the US, namely the sharp rise in the amount of money in US money market funds. There is well over USD 5 trillion in them, and this at an appreciation rate of over 5%. But at least some of this money may become bolder at the end of the year, according to strategists at Bank of America.

The volume of money in US money market funds has already exceeded USD 5.6 trillion at the end of September. This is money from investors who are more comfortable appreciating at somewhere slightly above 5% for the year than playing for higher returns in the stock market or longer-term bond market.

Money market funds in the US currently offer an annual return of just over 5%, whereas for most of the past decade they allowed virtually zero appreciation on the money invested. Even so, they typically held more than USD 2.5 trillion at the time.

Bank of America strategists therefore conclude that roughly half of the current money in money market funds is made up of capital from investors who, under certain conditions, should be willing to withdraw their money and invest it in riskier assets, led by equities.

These conditions may vary, but for many investors, any less uncertainty about monetary policy developments and more attractively priced equities would probably be an incentive. While the Fed still seems to be working with the possibility of one more rate hike before the end of the year and is counting on a longer period of higher rates than equity optimists had hoped for until recently, the declines in equity prices over the past two months have already made the market as a whole somewhat more attractive in terms of valuations.

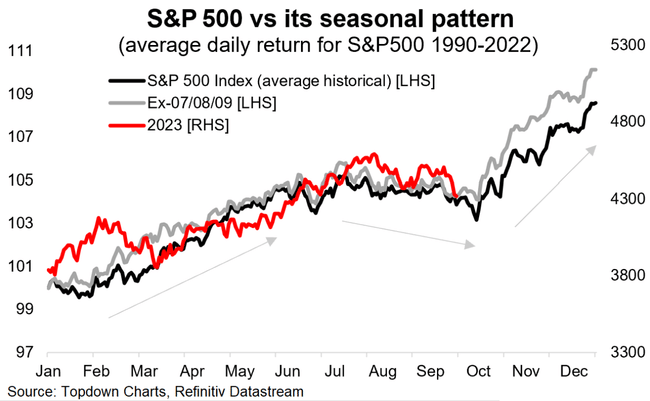

A possible successful third quarter earnings season could thus trigger a wave of some outflow of dollars from money market funds towards the equity market. And the major equity indices could thus confirm the traditional seasonal pattern of a rising end to the year.

So far it looks like the end of the year could be pretty green. History also shows it, but a lot of unexpected things can still intervene.

I feel sorry in advance for people who will try to short the S&P 500.