Willard Spencer

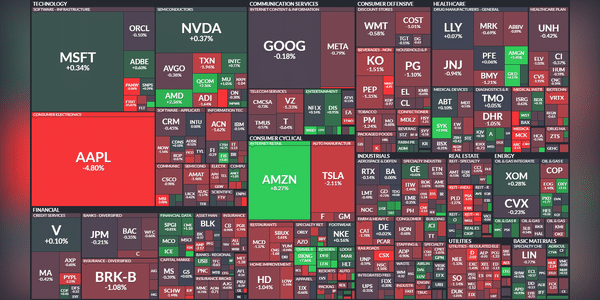

A week in the markets according to stock charts: US stocks recoup some of August's losses, S&P 500 index adds nearly a percent.

The streak of red weekly candles was broken, the S&P 500 index rose 0.82% for the week.

S&P 500

The S&P 500 index started the past week on an optimistic streak, which collapsed on Thursday when the index wrote off well over a percent. Thus, the green...

Read more

Zobrazit další komentáře

We are currently experiencing the biggest index correction of the year. But the summer months are exceptional for that. because most people are on vacation and the markets are either slowly selling off or resting. I think we could return to a spring setup in the fall.

Bob Doll (Crossmark GI): I continue to see a recession in the US, the stock market may write off over 10%.

Bob Doll is Chief Investment Officer at Crossmark Global Investments and former Head of US Equity Strategies at BlackRock. Despite the resilience of the US economy so far this year, he warns of a recession and a drop in the S&P 500 stock index into the 3,800 to 4,200 point...

Read more

Why not try to time the market? The answer can be found in this chart.

Once people get a feel for the stock market, they immediately think about how to increase their (potential) profits. Often, they go into market timing. But this can cost them dearly.

The following chart shows what a portfolio consisting of a ten thousand dollar investment in the S&P 500 index at the end of...

Read more

Is there any point in dealing with share valuation?

US stocks are expensive, investors have been hearing for years from all sides. Yet a major correction is not coming. Have standard valuation indicators stopped working?

The Shiller cyclically adjusted P/E ratio (CAPE) for the US S&P 500 has averaged 17.4 over the period since 1871. It is hard to doubt the relevance of this...

Read more

Zobrazit další komentáře

I have a similar opinion to Philip. You have to look at the individual sectors. Since tech stocks have been rising lately mainly because of AI. But other stocks from other sectors are either at average prices or some stocks are maybe even undervalued.

Zobrazit další komentáře

Beware, I know a bit about these techno-electrics and I can say that if it works in classical conditions as stated, it will be a revolution not only in the market, but also outside it. This could be a real breakthrough.

This is one interesting take on portfolio diversification for me :)

Why and how to include commodities in your portfolio?

Commodities are key to the functioning of the world as we know it today. They serve as a source of raw materials and energy for industry and agriculture. Stability of commodity supply is essential to the global economy, and commodity prices affect the economy...

Read more

Zobrazit další komentáře

If gold drops to $1800 I'll buy a few percent through ETFs to add to my portfolio.

Zobrazit další komentáře

I don't have this stock in my portfolio and if there was a correction and a drop, I would price it and buy it.

Zobrazit další komentáře

Thanks for the summary and new information. It was blushing nicely and the market was moving quite a bit. We'll see what happens next and I'm interested to see what happens with interest rate hikes, whether or not the Fed will raise them again this year.

Zobrazit další komentáře

I'm rather surprised that we know here that rates will take some time to kick in, but even so, many analysts are starting to work with a more positive scenario in the sense that we will eventually avoid a recession, etc.

Zobrazit další komentáře

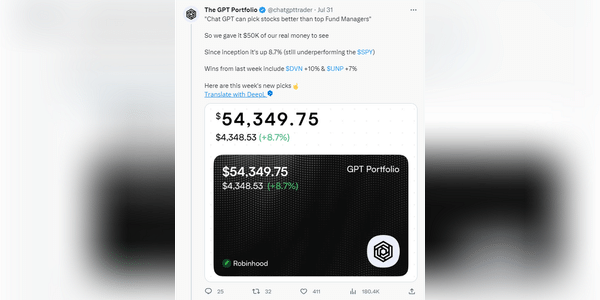

That's very nice. As you write, the robot is just at the beginning and just getting the hang of it and the results are very decent and I am very interested to see how it will fare going forward and in any downturns. I'll definitely appreciate some updates :)

Zobrazit další komentáře

As long as the economy improves, I don't think the ginseng will go down much

Zobrazit další komentáře

Let's wait and see what happens in the fall. I'm curious myself, but ready for anything. It's all so strange still. 😁

Zobrazit další komentáře

I'm scared of trading for now, but maybe when the kids are bigger I'll find the time and courage :)

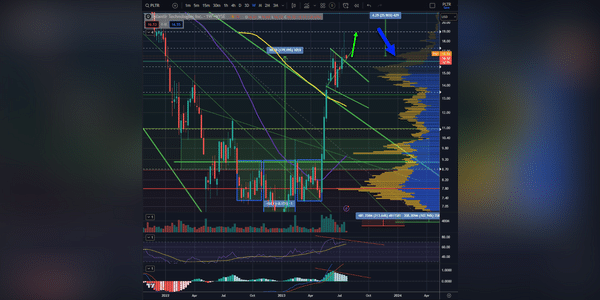

Nice and very interesting charts and thanks for them. I was looking in the comments to see where you were looking for the charts. I'll have to look at that Twitter ( currently X ) more often :D