A summary of the past week - everything you need to know!

U.S. stock indexes posted mixed results on Friday and for the week, as concerns about inflation and high interest rates persist

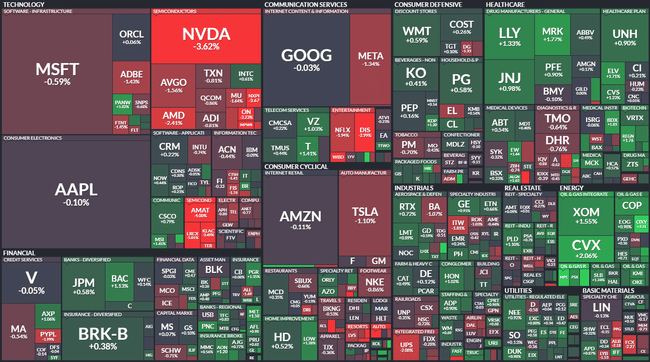

US equities closed Friday's trading mixed, with concerns about inflation and high interest rates persisting in the market. The indices also delivered mixed performance on a weekly basis.

The Dow index gained 0.30% on Friday to end trading at 35,281.40 points, but the broader S&P 500 fell 0.11% to 4,464.05 points and the Nasdaq Composite technology market index was down 0.68% to 13,644.85 points. The VIX volatility index fell 6.37% to 14.84 points and the yield on 10-year US government bonds rose seven and a half basis points to 4.158%

The U.S. Department of Labor reported this afternoon that annual producer price growth in the United States accelerated to 0.8% in July from 0.2% in June. Analysts in a Refinitiv poll had expected a slightly more modest acceleration to 0.7%.

The US producer price report led to a rise in US Treasury yields, which had a particularly negative effect on shares of large technology companies. Software giant Microsoft weakened by 0.59% and electric car maker Tesla by 1.10%.

For the whole of last week, the Dow rose by 0.62%, the S&P 500 fell by 0.31% and the Nasdaq Composite lost 1.90%.

The dollar firmed on Friday

In the foreign exchange market, the US dollar strengthened slightly against the euro on Friday, supported by a rise in US Treasury bond yields. Around 22.00 CET, the single European currency lost around 0.3% to USD 1.0945.

The most important Friday events on the US markets

The U.S. Supreme Court agreed to review a deal struck with Purdue Pharma in the so-called opioid crisis, at the behest of President Joe Biden's administration. Under the deal, its owners are to pay six billion dollars in exchange for immunity from civil lawsuits. When the court reconvenes in October, it will consider whether the deal exceeds the law. The hearing, where both sides will be able to present their arguments, will be held in December, according to Reuters. In the meantime, the court has suspended insolvency proceedings with the company.

A U.S. court on Friday revoked the bail of Samuel Bankman-Fried, the founder of bankrupt cryptocurrency exchange FTX. It concluded that Bankman-Fried had repeatedly tried to influence witnesses. This was reported by AP and Reuters.

The US producer price index rose by 0.8% year-on-year in July (estimate: +0.7%, June: +0.2%), month-on-month it increased by 0.3% (estimate: +0.2%, June: flat).

The University of Michigan's Consumer Confidence Index fell to 71.2 points in August according to pre-current data (estimate: 71 points, July: 71.6 points).

Highlights of the past week in US equities

Elon Musk confirmed that his online social network X (formerly Twitter) will never create its own cryptocurrency. He was responding to warnings about fraudulent tokens purporting to be associated with the platform.

US payments company PayPal Holdings has launched its own stablecoin called PayPal USD, with the acronym PYUSD, which is pegged to the dollar. This is an effort to encourage the adoption of digital currencies for payments and currency transfers. The company made the announcement in a press release on Monday. PayPal is the first major financial company to come up with its own stablecoin, which could significantly boost the slow adoption of digital currencies for payments, analysts point out.

U.S. packaged food maker Campbell Soup will buy Sovos Brands (+25.19%) for $2.3 billion, boosting its food and beverage offerings with premium Italian sauces. The company said in a press release on Monday.

Boeing's Starliner spacecraft won't be ready for its first manned flight until March next year. But it's not yet certain when the spacecraft, which was originally scheduled to launch last year, will finally make its maiden voyage. Officials from the US National Aeronautics and Space Administration (NASA) and Boeing representatives said this during a teleconference on the status of Starliner.

Consumer credit volume in the U.S. rose by $17.85 billion in June. It was expected to be just +$13 billion after May's $9.45 billion.

US video conferencing provider Zoom, whose name has become synonymous with working from home during the covid-19 pandemic, ordered its employees back to their offices. This was reported by the BBC.

The US trade deficit narrowed in June, with imports falling to their lowest level in more than a year and a half. Thus, the report published on Tuesday by the US Department of Commerce indicates a slowdown in domestic demand. The trade deficit narrowed by 4.1% compared to the previous month to USD 65.5 billion.

The US Small Business Optimism Index (NFIB) rose to 91.9 points in July (estimate: 90.6 points, June: 91 points).

US wholesale inventories fell by 0.5% in June according to final data (flash: -0.3%, May: -0.4%).

Some sellers on Amazon's online network are complaining that the company is withholding cash from them and that they are facing bankruptcy because of it. Amazon is defending itself, responding that it informed everyone of the change three months in advance and that this has been common practice elsewhere in the world for years. The BBC website reported on Wednesday. Amazon is withholding the money for seven days after delivery in case the customer claims the goods they bought.

Special investigator Jack Smith, who works on cases involving US ex-president Donald Trump, obtained a court order earlier this year allowing him to obtain information about Trump's account on the social network X (formerly Twitter). But the company complied with the order belatedly and was fined $350,000 by the court. This was reported by US media, citing published court documents.

Annual consumer price growth in the United States accelerated to 3.2% in July from 3% in June, marking the first increase in inflation since last June. This follows from Thursday's report of the US Department of Labor. However, the rise in inflation is more moderate than analysts expected, who in a Reuters poll estimated July inflation at 3.3% on average.

After years of preparation, Virgin Galactic has its first tourist flight into space. On Thursday, its machine transported a former athlete, among others, to an altitude of more than 80 kilometres, who bought a ticket back in 2005. The company of Briton Richard Branson wants to take flights into space every month, joining billionaires Jeff Bezos and Elon Musk's Blue Origin and SpaceX in the space tourism industry.

The United States will block and regulate American investment in Chinese technologies including computer chips, microelectronics, quantum information technology and artificial intelligence. The order was signed by US President Joe Biden on Wednesday. This will further increase tensions between the two superpowers, the BBC reported. China's commerce ministry said it was seriously concerned by Washington's move and reserved the right to impose countermeasures.

Billionaire Elon Musk is auctioning off logos and other items associated with the social network Twitter. It was only renamed X a few weeks ago. Among the 584 items on offer are coffee tables, large bird cages or oil paintings of paintings that have become popular by sharing them online. The BBC reports. The auction list also includes dozens of tables and chairs or a DJ booth. Bidders can also bid on musical instruments, enough to outfit an entire band.

American company Tapestry will buy Capri Holdings, owner of luxury goods brand Michael Kors and others, for $8.5 billion. The companies said in a statement on Thursday. The combined company wants to better compete in the global market with larger European rivals, Reuters reported.

The United States, Canada and Britain are imposing economic sanctions on Riyadh Salami, the former governor of Lebanon's central bank, AFP reported on Thursday. Salami, 33, has been under investigation for several years on suspicion of embezzling millions of dollars from state coffers, a charge he denies. He was head of the central bank from 1993 until late last month, and many analysts say his leadership contributed to the deep economic and financial crisis the country has faced for several years.

The number of new claims for unemployment benefits in the United States rose to 248,000 in the week to August 5 from 227,000 in the previous week, when a result of 230,000 was expected. The number of continuing claims in the week to 29 July fell to 1.684 million from 1.692 million in the previous week (revised from 1.700 million) when a result of 1.710 million was expected.

Last week's earnings season

Tyson Foods 2Q results: adjusted earnings per share of $0.15 (estimate: $0.26), sales of $13.14 billion (estimate: $13.63 billion).

United Parcel Service 2Q results: Adjusted earnings per share $2.54 (estimate: $2.49), sales $22.06 billion (estimate: $23.04 billion).

Under Armour 2Q results: Net earnings per share of $0.02 (estimate: loss of $0.02), sales of $1.32 billion (estimate: $1.30 billion).

Fox's 4QFY2023 results: adjusted earnings per share USD 0.88 (estimate: USD 0.72), sales USD 3.03 billion (in line with estimates).

Eli Lilly & Co's 2Q results: adjusted earnings per share $2.11 (estimate: $1.98), sales $8.31 billion (estimate: $7.58 billion).

Lyft 2Q results: Earnings per share of $0.16 (estimate: loss of $0.01), revenue of $1.02 billion (in line with estimates).

AMC Entertainment Holding 2Q results: Adjusted earnings/loss per share $0.00 (estimate: loss $0.05), revenue $1.35 billion (estimate: $1.27 billion).

Akamai Technologies 2Q results: Earnings per share $1.49 (estimate: $1.41), revenue $936 million (estimate: $931.52 million).

Take-Two Interactive Software's 2Q results: Earnings per share $0.54 (estimate: $0.29), revenue $1.04 billion (estimate: $984.52 million).

Walt Disney's 3QFY2023 results: adjusted earnings per share $1.03 (estimate: $0.95), revenue $22.33 billion (estimate: $22.50 billion).

PlugPower's 2Q results: earnings per share $0.40 (estimate: $0.26), revenue $260.18 million (estimate: $242.24 million).

China's online retailer Alibaba Group Holding's first fiscal quarter profit rose 51% year-on-year to 34.33 billion yuan. Revenue in the quarter ended June 30 then increased 14% to 234.16 billion yuan. The company made the announcement in a press release on Thursday.

Ralph Lauren's 2Q results: adjusted earnings per share of $2.34 (est. $2.14), sales of $1.50 billion (est. $1.48 billion).

News Corp's 4QFY2023 results: earnings per share $0.14 (estimate: $0.09), revenue $2.43 billion (estimate: $2.48 billion).