Feed

Paramount has officially raised its offer for Warner Bros. Discovery $WBD to $31 per share, and WBD is extending the window for negotiations as a result. I find the “sweetener” outside the price particularly interesting: Paramount is also adding a $7 billion regulatory breakup fee, which in practice is a message to shareholders — “we’re not afraid of antitrust risks, and if it...

Read more

The war between Netflix $NFLX and Paramount Skydance $PSKY is far from over!

The board of Warner Bros. $WBD is discussing whether Paramount could offer better terms regarding the sale. No decision has been made yet, so the board may continue to stick with the current agreement with Netflix.

...Read more

Zobrazit další komentáře

Bulios Black

This user has access to exclusive content, tools and features of the Bulios platform thanks to their subscription.

I think investors in $NFLX shares will make money even without WBD. But if Netflix were to get it, that would be awesome and I could watch more movies😄

Bulios Black

This user has access to exclusive content, tools and features of the Bulios platform thanks to their subscription.

Disney delivered pretty good numbers (in the flash news), but not good enough to outperform Netflix. In recent years Netflix has grown tremendously and $DIS isn't able to grow at the same pace. I sold $DIS shares some time ago and if I didn't already have so many positions, I'd almost certainly buy $NFLX now.

Is $DIS still interesting to you, or is $NFLX simply a much better and...

Read more

Zobrazit další komentáře

I think it's hard to compare. Disney isn't all-in on producing films, series and documentaries. It also has parks, cruise ships and many other businesses where Disney has unevenly better years alternating with weaker ones (not to mention costs, the pandemic that reduced attendance in its entertainment segment, rising prices, etc.). On the other hand we have the content king, which aggressively improves monetization, content and advertising — Netflix. If you focus purely on streaming, Netflix led, leads, and will probably continue to lead.

Netflix reported its results yesterday, which came in well, and it’s clear this company is simply a money machine. Sentiment is now negative and the shares fell by about 6% after the close, which I would view simply as an opportunity and a discount. I already own other stocks, but the business is really great and the valuation is interesting right now.

Zobrazit další komentáře

I am just a beginner here and I bought 4 shares, because the price seems to be really cool at the moment. I don't want to risk buying more due to lack of experience. On the other hand, the price of the stock is so great, that it looks like a opportunity, because the company has clearly amazing results and good future.

Hi investors.

I currently have some cash available.

I'm toying with the idea of opening a small position in $NFLX — how do you personally view this company? I've looked into some information and their price looks interesting to me. I've been following this company for a while, but I'd be interested in more people's perspectives.

I also have an interesting position in $AMZN, where...

Read more

Zobrazit další komentáře

Netflix is a solid company; its valuation looks great right now. As for Amazon, the stock hasn’t been rising much lately, but the results were excellent and that growth should come over time.

Zobrazit další komentáře

Bulios Black

This user has access to exclusive content, tools and features of the Bulios platform thanks to their subscription.

Beautifully diversified portfolio. I wish you lots of luck in the New Year.

What do you think about the recent developments around Netflix? Are you buying the stock?

$NFLX announced the takeover of rival company $WBD, which includes, for example, the streaming platform HBO. Paradoxically, this has had a negative effect on the stock and over the past month it has fallen by approximately 10%. Netflix shares hadn’t experienced any significant decline for a...

Read more

Zobrazit další komentáře

Bulios Black

This user has access to exclusive content, tools and features of the Bulios platform thanks to their subscription.

Well, PARA and Trump — it looks like there could even be a reversal, and I wouldn’t mind at all if that deal fell through; then, with subsequent results, Netflix could be sold for a nice gain. I opened my position at the first drop after the announcement, and if it goes to 90 I’ll be buying more.

Shows like Game of Thrones and similar titles are what Netflix would need under its umbrella, and over a five-year horizon that would push Netflix several steps forward, especially combined with live sports broadcasts.

Anyway, I’m curious to see the next earnings and how this acquisition will turn out.

$NFLX split its shares 10-for-1 today

Netflix today carried out a 10-for-1 stock split. Each investor received nine new shares for every one original share, so they now own ten shares instead of one.

The aim of the move is to lower the price of a single share to make it more accessible to employees and small investors. A lower price can bring increased trading interest and...

Read more

Zobrazit další komentáře

Retail sentiment will probably be better, but I don't see anything special about it. :)

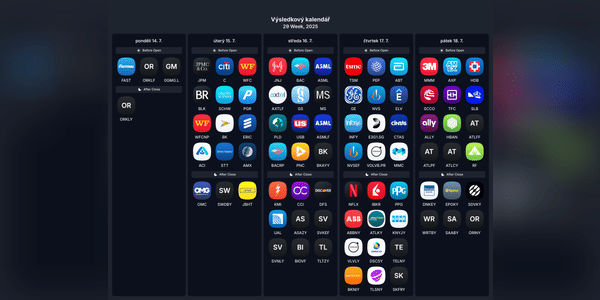

📅 This week's key events!

The results season begins! Apart from inflation data, US banks, tech firms and consumer companies are the main ones coming to the fore.

📌 Monday

Market reaction to Trump's tariffs announcement.

Results before markets open:

Orkla $ORKLY - Scandinavian giant in food, household chemicals and consumer goods.

📈 Tuesday

US CPI Inflation - The monthly consumer...

Read more

Zobrazit další komentáře

There's a lot in there, but for me it's definitely $NFLX and it will be interesting to see the stock reaction to the tariffs today.

Yesterday, Netflix was still reporting results. Overall, the company did very well and the results exceeded expectations. I would have happily bought$NFLXstock if it had fallen to a lower price, but even in these uncertain times, it's not selling off much. The stock is already up 9% since the beginning of the year.

Do you have $NFLX in your portfolio? At what price would you...

Read more

Zobrazit další komentáře

I'm very interested in $DIS right now. The stock has dropped significantly this year, but the company is still doing quite well and I'm thinking of buying in.

It doesn't even surprise me anymore — it'd be great if this whole game would just end already 😃. Otherwise, I'm also rooting for Netflix.