The economy is slowing and inflation will not return to central bank targets immediately. That's why we prefer value stocks, emerging markets and commodity producers

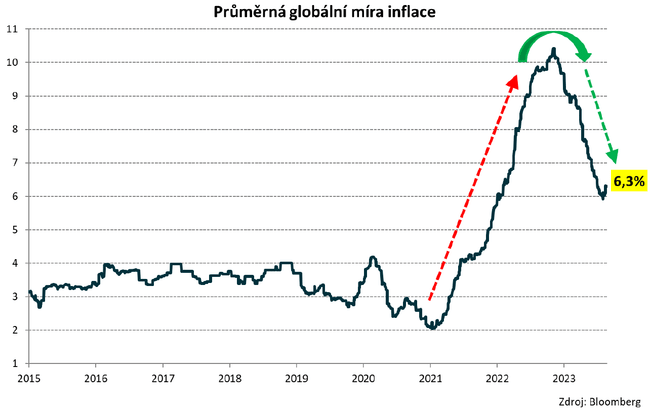

The fundamental cause of the still significantly elevated inflation is the unprecedented monetary and fiscal stimulus of the pandemic economy (2020-2021) from a global perspective. Their effects are still being felt in the economy and markets today.

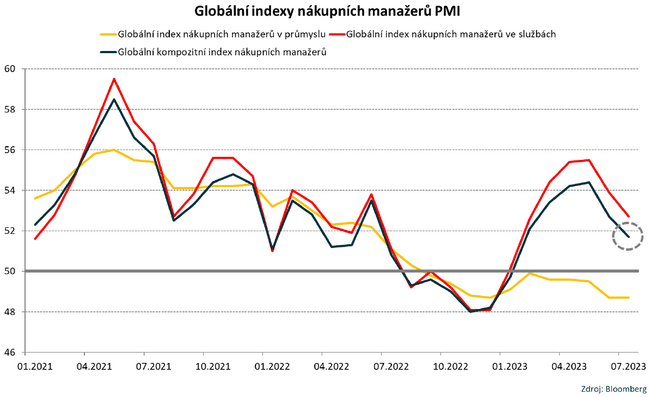

The momentum of the global economy has been slowing in recent months. This is particularly evident in the euro area, specifically in Germany.

Inflation across the world economy remains strongly elevated. It is unlikely to return to the 2% inflation target for quite some time.

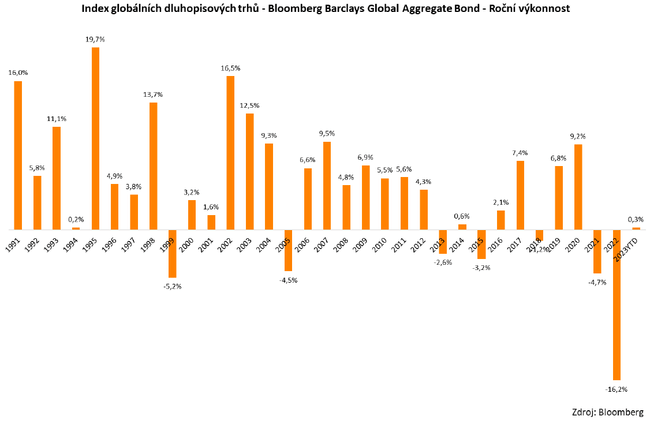

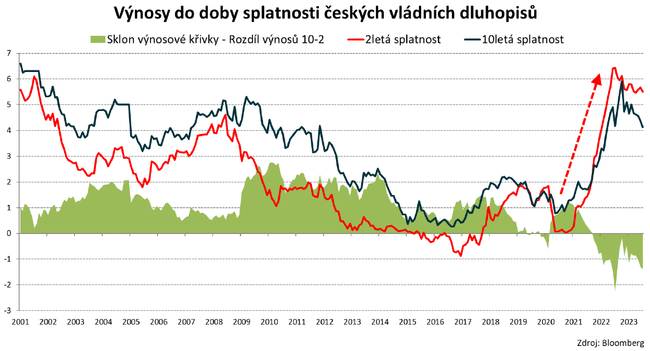

Global bond markets have become substantially cheaper in recent years. However, they are still not very attractive in our view, even in the face of still strongly elevated inflation and record budget deficits in key economies.

We therefore continue to maintain a strongly underweighted duration in Czech government bonds.

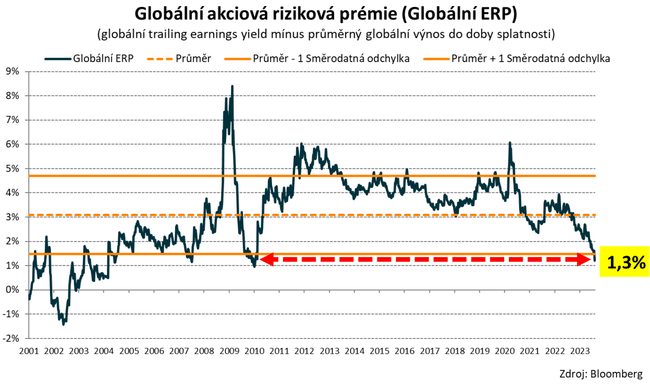

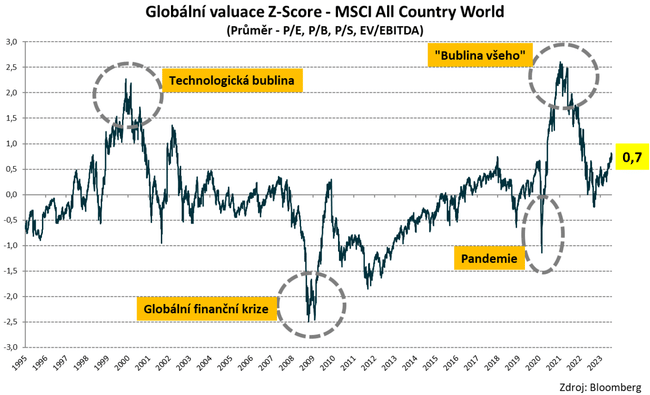

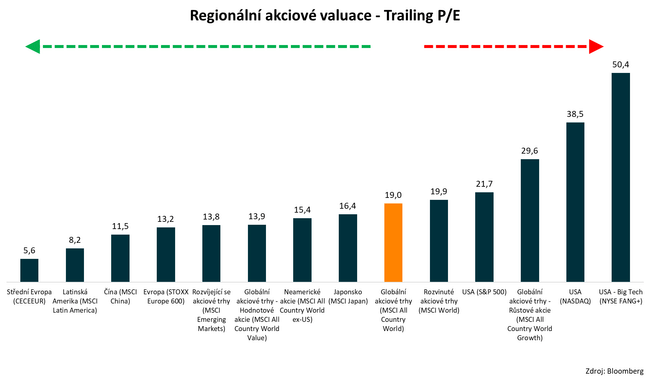

Equities are generally expensive, due to the extreme overvaluation of the US market.

We prefer value stocks, emerging market stocks and commodity producer stocks.

Nice and very interesting charts and thanks for them. I was looking in the comments to see where you were looking for the charts. I'll have to look at that Twitter ( currently X ) more often :D

Commodities and bonds usually go in the opposite direction to stocks. it's not always the case, but it's good to know. Logically, it makes sense. The last few years have clearly been for stocks, but that ratio can change over time.

Nice charts, thanks for the post!

We're in for some interesting times. And the CNB wants to lower rates.