Higher US rates are being felt.

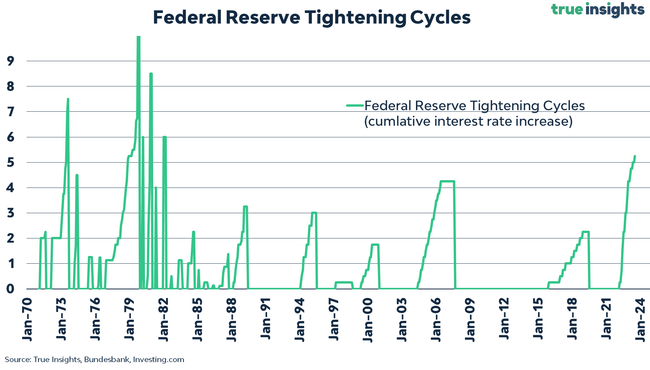

Investment strategist Jeroen Blokland of True Insights published a chart of the cumulative rise in the U.S. central bank's benchmark interest rate in every rate hike cycle since 1970. A very important chart.

In the current rate hike cycle, which began in March 2022, the Fed has already raised the base rate by 5.25 percentage points to the current 5.25%-5.50%. This is the steepest US interest rate hike cycle since the early 1980s, the period when Paul Volcker was Fed chief.

Given that the US economy is now far more "financialised" in terms of absolute debt volume (at close to $100 trillion) than in the early 1980s, the current much higher interest rates are having a much stronger impact on the US private sector in particular.

And the US private sector is already feeling the impact of high interest rates. As far as US households are concerned, average interest rates on credit cards have risen substantially, and the number of borrowers who are having significant problems repaying the loans on their credit cards is also rising. At the same time, average interest rates on mortgage loans have risen very substantially, so that the volume of new mortgage originations has slowed considerably and US house prices have started to fall. The number of corporate bankruptcies is also rising noticeably, with the current level already at pandemic 2020 levels.

It is true that the effects of changes in monetary policy have been delayed. Economic theory usually works with a horizon of 12-18 months. Given that the Fed also raised rates in July and did not rule out moving them higher at the September FOMC meeting, the biggest "pain" due to substantially higher interest rates hitting the US private sector is yet to come in the coming quarters.

I'm rather surprised that we know here that rates will take some time to kick in, but even so, many analysts are starting to work with a more positive scenario in the sense that we will eventually avoid a recession, etc.