Bob Doll (Crossmark GI): I continue to see a recession in the US, the stock market may write off over 10%.

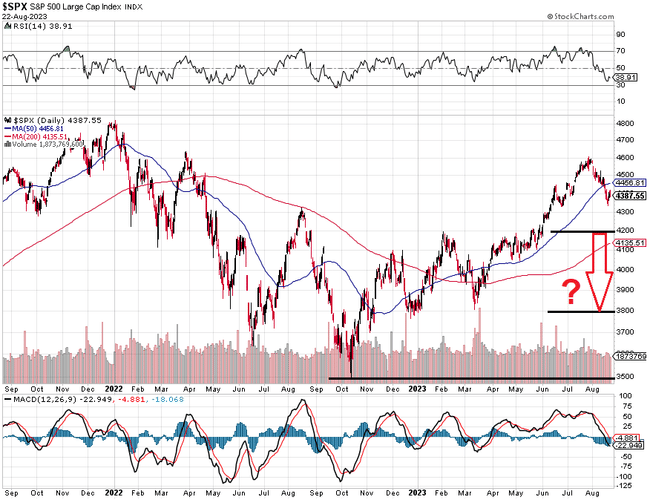

Bob Doll is Chief Investment Officer at Crossmark Global Investments and former Head of US Equity Strategies at BlackRock. Despite the resilience of the US economy so far this year, he warns of a recession and a drop in the S&P 500 stock index into the 3,800 to 4,200 point range.

The Fed continues its hawkish monetary policy, but the US economy as a whole has surprised positively so far this year and the stock market is holding interesting gains despite the weak August performance so far. Economists at both Bank of America and JPMorgan have therefore also adjusted their economic outlooks in recent weeks and no longer consider a recession as a base case scenario.

But Bob Doll remains cautious. "At the beginning of the year, I expected a recession to start sometime between September and the end of the year. It's too early to change anything on that," he says. "The word recession has stopped being bandied about so often, but I'm keeping it in my vocabulary for this year for now."

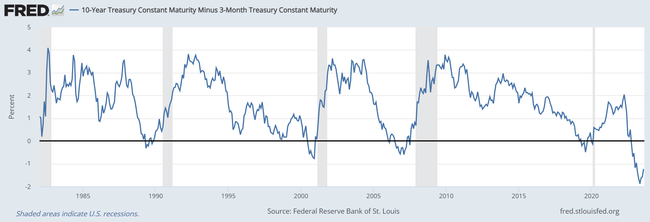

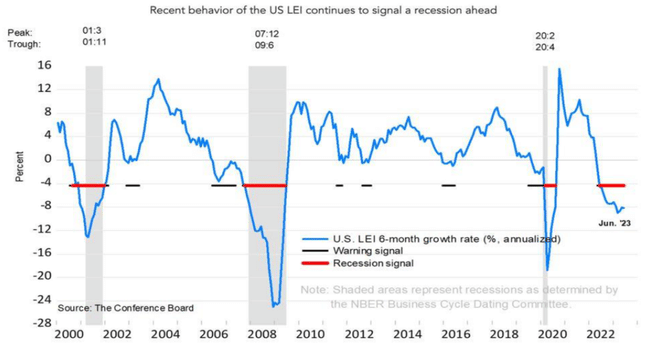

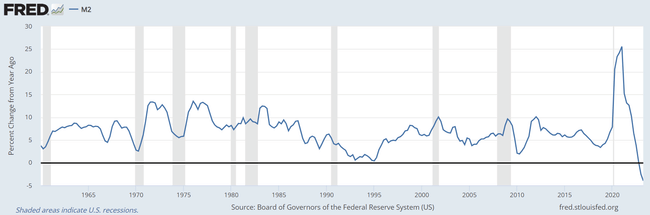

Economists are especially optimistic about the U.S. labor market data, but Doll is watching leading indicators rather than past data. Specifically, he continues to monitor the strongly inverted US government bond yield curve, leading indicators and also the money supply.

The inversion of the yield curve has presaged all recessions in the US since the 1960s (not all recessions have been preceded by an inversion, however). Bond investors are signaling that they do not trust the US economy as much in the short term, and so are seeking relative safety in longer-term bonds.

The Conference Board's Leading Indicators Index then tracks ten components, including manufacturing activity, consumer sentiment, housing market activity, stock performance, jobless claims, and lending activity. And this index has not inspired optimism for some time.

And finally, the year-on-year evolution of the money supply (M2). This is falling year-on-year for the first time in history as a result of quantitative tightening by the Fed, which means nothing more than a decline in liquidity in the economy. This is undoubtedly not conducive to economic activity.

Moreover, Doll reminds us that the Fed's high rates are only gradually trickling into the economy. "The Fed raised interest rates at a record pace of five percentage points. To think that the only problem was the one in the banking sector in March, which lasted a few days, and now everything will go smoothly, I think would be very naive," he explains.

He therefore continues to envisage a recession in the US economy in the baseline scenario, but only a mild one given the strong fiscal and monetary support in recent years. Nor should stock prices experience any drastic drop, but the correction is well underway, according to Doll. He predicts a drop in the S&P 500 index to the 3,800 to 4,200 point range, but does not foresee a fall below last year's lows.

So I wonder if Bob will be right. It's fall so we'll see:)