US stocks weakened on Friday after the labour market data. The whole week was also a loss for the major indices.

Stocks in the United States weakened on Friday after initial gains and all three major indices posted losses for the week as well. The uncertainty was taken care of by the labor market statistics for July and the outlook for Apple.

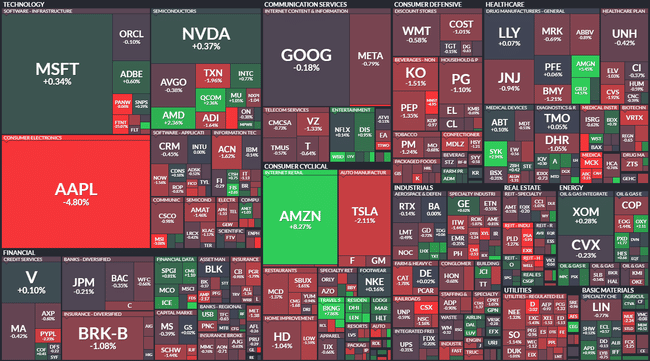

The Dow index lost 0.43% on Friday to end trading at 35,065.62 points, the broader S&P 500 index fell 0.53% to 4,478.03 points and the Nasdaq Composite technology market index fell 0.36% to 13,909.24 points. The VIX volatility index jumped 7.41% to 17.10 points and the yield on the 10-year U.S. government bond fell nearly 15 basis points to 4.042%.

The U.S. economy created approximately 187,000 non-farm jobs in July, less than expected. However, the unemployment rate fell 0.1 percentage point to 3.5%, reaching its lowest level in more than 50 years. Wages also rose above expectations last month.

Some see this as a signal that the cycle of interest rate rises in the US is probably over. Sceptics, however, are taking a wait-and-see stance, stressing that the US central bank will continue to keep the door open to tightening monetary policy.

"There's still a lot of uncertainty stemming from geopolitical issues, the Ukraine war and the situation around China," said analyst Greg Bassuk of AXS Investments. Investors, he said, are repositioning to be prepared for possible negative surprises.

Shares of online retailer Amazon added 8.27% after the company unveiled a positive outlook for the third quarter. Shares of technology company Apple, on the other hand, fell 4.80% as the iPhone maker forecast a continued decline in sales.

Over the past week, the Dow fell 1.12%, the S&P 500 shed 2.27% and the Nasdaq Composite declined 2.85%. The S&P 500 and Nasdaq Composite posted their most significant weekly declines since the week ending March 10.

The dollar weakened against the euro and a basket of currencies on Friday

The dollar did not fare well in the foreign exchange market on Friday. It wrote off almost all of this week's gains following the release of the labor market data for July. Shortly before 22.00 CET, the dollar index, which measures the value of the dollar against a basket of six major world currencies, lost 0.5% to 101.99 points. The euro added 0.6% to the dollar at the same time to $1.101.

Thanks for the summary and new information. It was blushing nicely and the market was moving quite a bit. We'll see what happens next and I'm interested to see what happens with interest rate hikes, whether or not the Fed will raise them again this year.

Some of the capital from the stock market has moved into the bond market. My guess is that this will continue as interest rates on bonds rise and the economy slows.

I haven't seen that Apple in red in a while. It's about time. 😁

Booking also made a nice percentage. Such a seasonal increase, you could ride that.

Thanks for the recap.

The Amazon one with +8.2% shines nicely there... :)