Don't rely on the Fed. And don't even try to beat him!

After the financial crisis of 2008, the idea that US stocks could only go higher took root among investors. This was based on the assumption that if the market got into trouble, the US Federal Reserve would step in to maintain overall economic stability. Such considerations should be strongly warned against.

It is dangerous to bet that the market will somehow evolve according to current or expected interest rate settings. The fact that US equities started a new uptrend in spring 2009 is not (only) related to the fact that the US Federal Reserve had shortly before that cut interest rates to virtually zero. Back then, it was mainly fundamentals that played a role, i.e. the growth in corporate profitability.

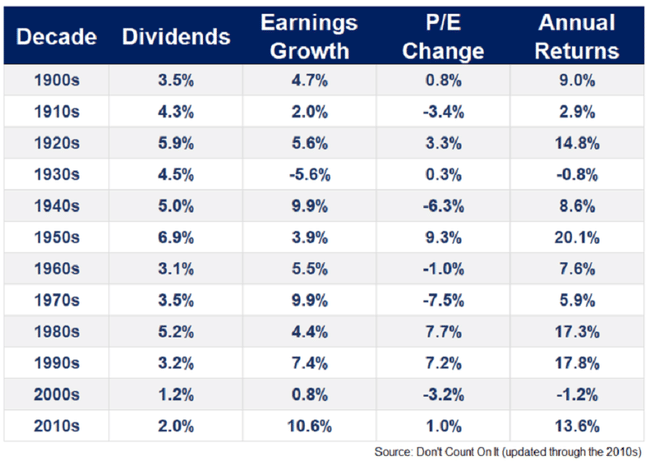

US stocks - dividend yields, profitability growth and annual performance

We don't have to go far for another reason not to follow rates in relation to share price performance. Anyone who expected technology stocks to suffer as US central bank interest rates rose is experiencing a major disappointment. Indeed, the current stock rally on Wall Street is being driven by technology titles.

There is a lot of market wisdom, recommendations and rules of thumb among investors. For example:

"Be greedy when others are cautious."

"Be careful when others are greedy."

"Buy when the stock markets are bleeding."

"The trend is your friend."

"Don't catch a falling knife."

"Sell in May and Go Away."

"Don't put all your eggs in one basket."

"Concentrate to get rich, diversify to keep the wealth."

At first glance, it's obvious that some of the advice goes against the grain. Most importantly, it's clear that not all of them can be followed at all times. It's the same with betting on how the market will perform depending on rate settings.

As long as the economy improves, I don't think the ginseng will go down much

I'm signing! 👏

This growth cannot last forever. The pendulum will swing. Otherwise, I guess the '50s were a good time to invest. 😉

Everyone needs to keep this advice in mind. Sometimes we tell ourselves that it is easy to write it down, but it is still not easy to follow it. But everyone has to figure that out for themselves...