Why not try to time the market? The answer can be found in this chart.

Once people get a feel for the stock market, they immediately think about how to increase their (potential) profits. Often, they go into market timing. But this can cost them dearly.

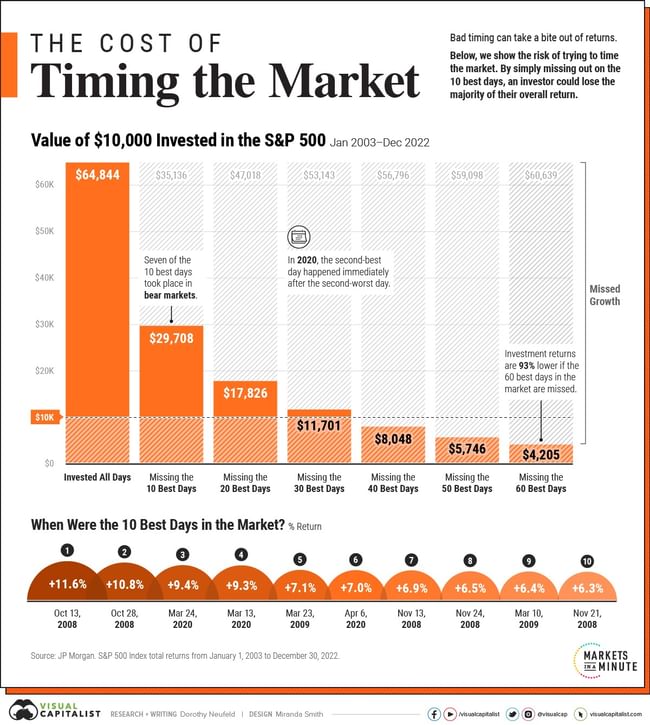

The following chart shows what a portfolio consisting of a ten thousand dollar investment in the S&P 500 index at the end of last year would have been worth at the beginning of 2003 if the investor had let the funds appreciate over time and if he had not had the money invested during the ten to sixty best days of the market over that time horizon.

The seemingly insignificant number of days in a twenty-year horizon has a huge impact on the value of a portfolio. A buy-and-hold strategy would value an initial investment of ten thousand dollars at nearly $65,000. Even omitting the ten best days, seven of which (ironically) fall during bearish trends, the result would be less than half that. And by missing the 40 best days, the investor would have already added up the losses.

"Market timing looks simple - buy when prices are low and sell when they peak. But the reality is different. Even a small mistake can substantially reduce overall returns, or knock them straight into the red," warns Dorothy Neufeld of the Visual Capitalist website.

Does any broker support the DCA style of investing, where you choose an amount and it automatically buys the selected stock/etf for the chosen amount each day? Let me know in the comments please. :)