Bank of America: Hedge funds are bracing for worse times and are overconfident in these 20 stocks (part 2).

Continued from yesterday's status:

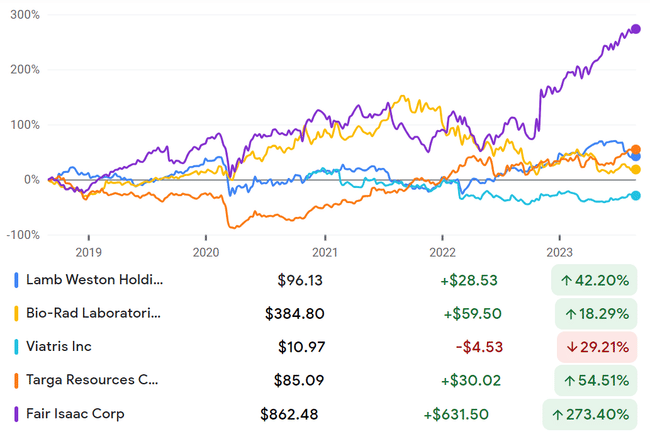

11. Lamb Weston

Sector: essential consumer goods and services

Difference in LONG and SHORT positions: 10.1%

12. Bio-Rad Laboratories

Sector: Healthcare

Difference in LONG and SHORT positions: 10 %

13. Viatris

Sector: Healthcare

Difference in LONG and SHORT positions: 9.2%

14. Targa Resources

Sector: Energy

Difference in LONG and SHORT positions: 9.2%

15. Fair Isaac

Sector: Technology

Difference in LONG and SHORT positions: 9 %

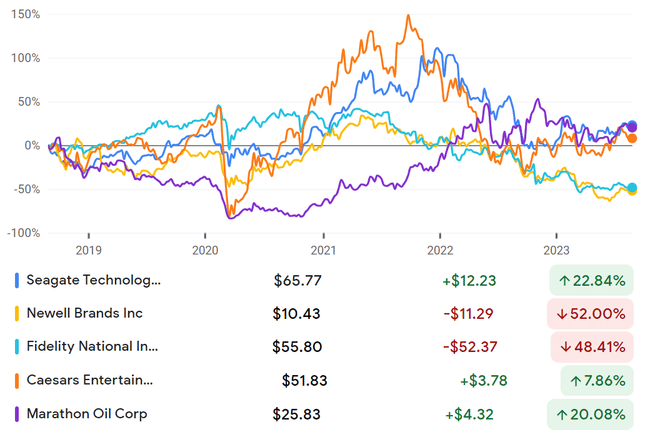

16. Seagate Technology

Sector: Technology

Difference in LONG and SHORT positions: 8.6%

17. Newell Brands

Sector: Residual Consumer Goods and Services

Difference in LONG and SHORT positions: 8,4 %

18. Fidelity National Information Services

Sector: Finance

Difference in LONG and SHORT positions: 8,4 %

19. Caesars Entertainment

Sector: Residual Consumer Goods and Services

Difference in LONG and SHORT positions: 8.2%

20. Marathon Oil

Sector: Energy

Difference in LONG and SHORT positions: 8.1%

And that's it :)

Fair Isaac's performance here is truly admirable, at least the one that's shown on the chart. I guess it's too late to go long there...