$WPC is down more than 7% today on news that the board has approved a plan to exit office assets within its portfolio.

This plan includes:

1) Spin-off into a separate publicly traded REIT, with 59 office properties to be transferred to Net Lease Office Properties (NLOP).

2) Sale of office assets: 87 office properties will remain owned by $WPC and will be sold by January 2024.

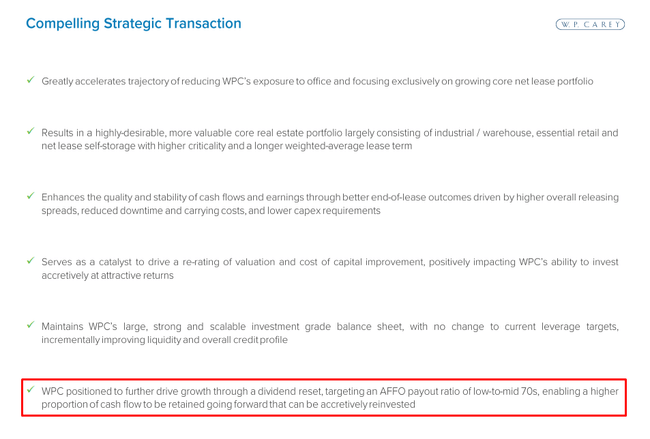

The report also mentioned a "dividend reset", which has investors fearing a potential dividend cut (see image below).

I am attaching a link to the presentation:

https://s29.q4cdn.com/223055717/files/doc_presentations/2023/09/W-P-Carey-Strategic-Office-Exit-Presentation.pdf

I was very interested in WPC. However, I have mixed feelings about this news and will wait a while to buy.

Well, the direction of the price is unfortunately clear to me. Next stop is probably the covid bottom...

So what do they primarily want to focus on?

Well I've just finished reading it as well and I'm so confused, on the one hand it's probably a good thing because this sector is losing money, offices just don't fill up that much anymore, on the other hand, some income has certainly benefited, so I don't know what to think? 🤔 ...I'm curious for opinions.