$BTI released results today. 👇

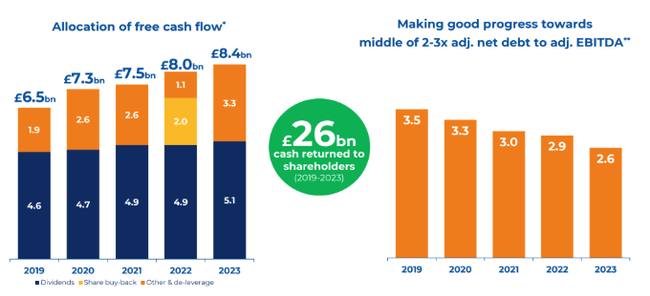

The main positives are the rapid reduction in debt (adj. net debt / adj. EBITDA 2.6x). This is especially important as management has long targeted debt reduction to initiate buybacks. At the current price, these could have a significant impact on the exchange rate. Another important milestone is the break-even in the NGP (next generation products) segment, 2 years ahead of the originally planned date! Last but not least is the effort to monetize the stake in ITC, which is very substantial.

The negative news is, for example, the lower volume of cigarettes sold in the US. So an accelerated downward trend.

The results of the "tobacco companies" were pretty scattered this week and so were their stock movements :) Some up, some down. $BTI was up nearly 7% yesterday, but the premarket isn't favoring the company and the stock is down 1.7%. We'll see how this plays out. It's a tough business at the moment. Cigarette sales are down.

So great, I'm glad to see any company reducing debt and BTI needs it. Overall I had BTI stock at -, but yesterday the green finally showed up :)

Those cigarettes will go down for me in the long run. I think the new generation and young people in general will follow in the footsteps of electro etc... They might have come up with a replacement by now although competing in this PM probably won't be easy. Or am I completely off base ? :D