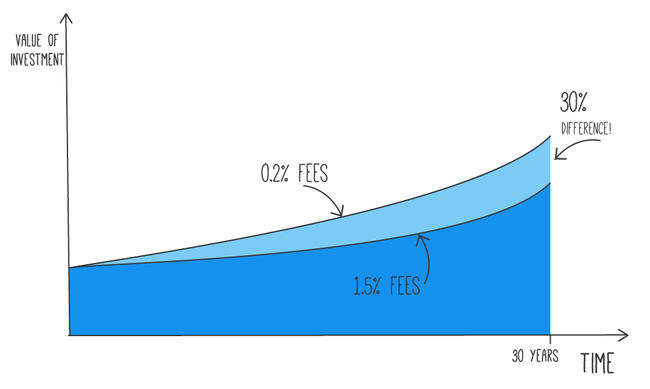

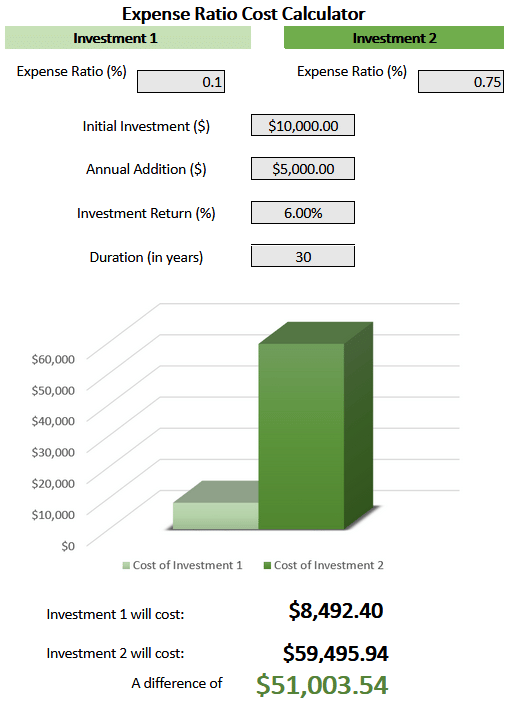

When picking an ETF, be careful of the TER (total expense ratio) in the long run makes a huge difference in the outcome.

I point this out because I see the India ETF discussed here often. These are the ones where we can run into higher ERs than we are used to with regular US ETFs. ❗

On the other hand, in the case of a shorter investment horizon, it will not make such a difference. Moreover, it assumes the same return, which is obviously not what the above-mentioned do not expect from investing in India - on the contrary, they expect a significant outperformance of classic mainstream ETFs. That's why they're in.

Great, thanks for the info.

Thanks for the heads up! 👍

I think that TER for example for Indian ETFs will be lower over time just to attract investors.