Self-assessment of the first half of 2023

Okay, it's the weekend and the year has swung into its second half. We often see different reviews now, what worked and what could have been done better, so I thought, I'll go to the market with my skin too. 😁 As I try to include some interesting information in each of my posts that can help, so now this will be purely my summary for 6 months, what went well, what didn't and my opinion on what to look out for next.

I started stock investing at the end of summer 2022. I consider myself a beginner even though I have been playing with cryptos for some time before stocks. I switched to equities because of what I believe to be better fundamentals and interest in the company, I stayed with cryptos as a loyal BTC hodler.

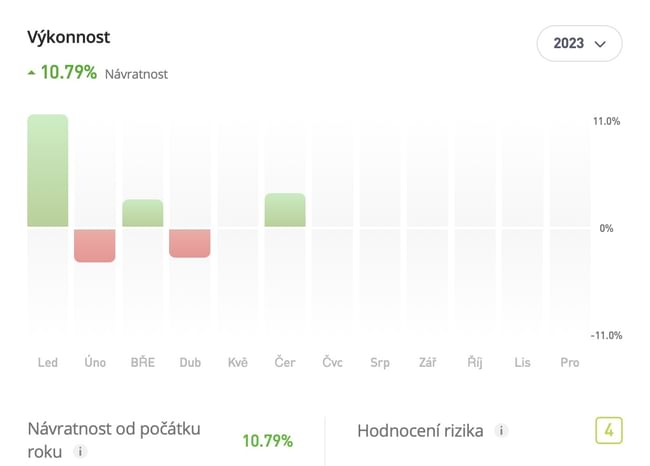

Now onto the numbers. As of 1/1/2023 to 6/30/2023 my portfolio is +10.79%. $7000 invested. Portfolio at eToro broker. Nick Lukyn13, my profile is transparent so who is also on this broker can look me up and give each other a follow.

January: +11.03%. February: -3.25%. March: +2.68%. April: -2.78%. May: 0%. (I don't think I can finish an active month like this)🤦♂️ June +3.31%.

On my portfolio, it is made up of 31 stocks and 2 ETFs. I will not list all 33 titles, or if there is interest we can then in personal messages or as I wrote, at the broker I am visible publicly.

The portfolio is largely made up of big tech from Microsoft, Apple, Meta, Amazon, Google. Also some positions in Disney, which I believe in, then Blizzard, such a favorite from the games growing up. This year I'm also already betting on travel in the form of Airbnb,(lodging) and Delta Air Lines,(aviation). I also have reits represented here in the form of Reality Income, WP Carey, from where I'm transitioning into healthcare, still the MPW reit, and then the lure of CVS. Unfortunately, I also hold my bad investment and that is in the form of Novavax. Then I take these as super defensive companies, trading Procter & Gamble, Costco. Plus, they're great as dividend stocks too. I continue to hold those in companies like ENB, STAG, PBA. I also had RIO and PBR, the dividend mining sector, but I sold at a profit, I'm worried about sustainability here, although maybe wondering if it was a waste and I wouldn't go back in on a downturn. Banks, here I have a larger presence in BAC and a smaller one in JPM. Then energy, oil - here I believe in OXY, recently bought up, then not very popular with investors, but I hold green SHELL and finally ENPH, (solar) there is a decline now, but they have a strong business model and growth is expected in the future. ETFs I have are SPY and FTSE 100 (index of the 100 largest UK companies). I also have PYPl, BTI, WBD and others, but I don't place as much emphasis there and plan to sell at a profit over time.

My strategy. I started with 100$, so first I mainly wanted to grow, make money and invest that again. I've gradually diversified my portfolio across sectors and as the amount invested grows, I'm starting to look more at dividends. I am learning with time and trade. All in the same account, I want to change that in the future and here the numbers are more in the red. Approx - 300$. I also have some good trades under my belt but it's not ideal yet, unfortunately due to one account it's reducing my overall performance.

My look back: I'm very much hooked on investing and even though I've only been in stocks for a year, I've learned a lot and moved up in financial literacy, which was nonexistent for me in the past. I want to be an inspiration that you can start at any time, in any situation and even with "change" 😁.

The second half of last year was a down year, but I steadied the red numbers and in turn used them to make some purchases around the October/November dips. In January continued with buying where prices were still holding down such as Google, Meta and gradually enjoyed good positions and gains. What I slept on and had no idea what a boom it would be is AI, too like Nvidia or AMD I didn't catch. Otherwise, I believed 2023 would be better already, despite the continued rise in interest rates. Started to see inflation coming down slightly, investor sentiment still buying them too and the hype around AI helped it a lot. I don't expect that kind of growth in the next half of the year, I think the cool down around AI is slowly coming, profit taking and the Fed's continued battle with inflation. A market slowdown and talk in the air of at least a mild recession in 2024. On the other hand, I don't expect big declines either. Thus, I am lightly still overbought outside the big tech sector and adding to my smaller positions. I want to add another $3000 by the end of the year and top $10k. Goal --> maintain +10% appreciation. 💵

Thanks for reading this far and I look forward to hearing your results, where you stand, how was the first half of 2023 from your perspective 🍀.

I see that $ENPH has the most weight, hopefully you can turn it around there, it would do a lot in overall profit. Fingers crossed, 10k is already a pretty decent amount, don't forget the power of compound interest, it will only get better!

For me, it's just under +39% for the first half of the year. I'd like to finish 2023 with +50%, so I'll see if the economic situation goes my way. And if it doesn't, that's okay - I'm constantly adjusting my portfolio to the situation and I think it's possible to operate even in adverse times. The main thing is that we enjoy it. 😊

Personally, I have + some 14%... the important thing is that I went from - xxx to the same number only in + xxx. :D Nicely written, cheers to investing!