Analysts raise target prices for the S&P 500

Investors who follow market developments cannot overlook this year's rise in stocks and the increase in Wall Street forecasts that followed that trend.

Strategists at several firms have raised their 2023 target prices for the S&P 500 in recent weeks after the index rose more than 15% in the first half of the year. Fundstrat's Tom Lee last week set a new high target for the index, predicting that the S&P 500 will rise from its current level of around 4,400 to 4,825 by the end of the year. Previously, Lee had expected the index to reach 4,750 by the end of 2023.

While most of the discussion about expectations concerns what "top-down" strategists are predicting for the companies in the S&P 500 as a whole, analysts covering individual stocks have gradually become more optimistic about the index's prospects in recent months.

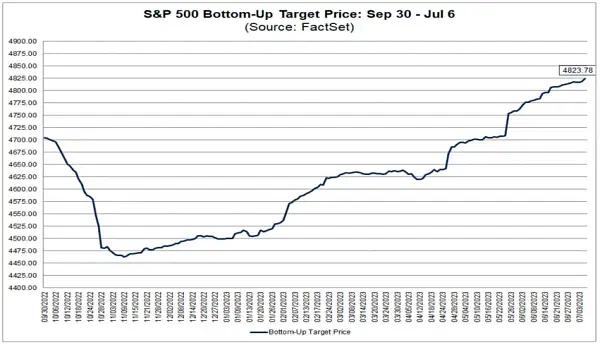

Last week, a team from FactSet looked at estimates for the S&P 500 - that is, aggregations of analysts' price targets for companies in the index - and found that industry analysts expect the index to reach 4,823 over the next 12 months, representing about 9% growth.

If we look at the following chart from FactSet, we can see a few key points that may be of interest to investors.

Expectations for the S&P 500 rose from the end of January to the end of February as first quarter results were better than expected.

Then, in late April, several large technology companies presented results that exceeded expectations. Then, in late May, Nvidia (NVDA) announced one of the biggest outlook increases ever seen for a company of its size.

The optimism of corporate analysts toward the stock shouldn't surprise anyone. Work from FactSet last year found that 57% of analysts' ratings for stocks were "buy" or equivalent ratings, while only 6% of the ratings for all stocks in the S&P 500 were "sell" or equivalent.

As Bloomberg's Matt Levine wrote many years ago: the value that Wall Street analysts provide is that they ensure that their clients have some level of access to corporate management teams.

Analysts also offer clients a pre-packaged financial model of a company that they can later tweak themselves - and potentially they are industry experts ready to answer questions from a more generalist investor, such as a hedge fund manager who wants to learn about the chemical industry.

In other words, whether Wall Street analysts are actually recommending what stocks will go up and by how much is not entirely their job. And so it's often the case that most stocks get good ratings because the analyst's job is to maintain a relationship with company management.

If corporate analysts are criticized for being too pandering to the companies they follow, then strategists are often criticized for simply following the market up or down.

But this second criticism is too simplistic. And it's especially true when looking at how analysts have changed their collective stance in recent months.

Stocks are rising because earnings expectations are rising. Over the long haul, earnings are the driving force behind stock growth.

And as is true on Wall Street and in life, the biggest difference between strategies, analysts and stock prices this year has been time. But things seem to be getting more in line.

How do you think analysts' estimates translate into your investment decisions?