Despite all the hardships of recent years, there are stocks that have managed to turn them into profits. They are no longer at their peaks and for many investors this may be a chance to discover new potential.

TransMedics $TMDX

TransMedisc is an American biotechnology company that specializes in the development and manufacture of devices and technologies for the preservation and transport of organs for transplantation. Their main product was the Organ Care System (OCS), which allowed for the perfusion of organs outside the donor's body, increasing the chances of a successful transplant.

With second quarter sales growth of 156% and 93% to 103% revenue growth for the year, the company is in a very rapid growth mode. The company's price-to-sales (P/S) ratio of 12 (the lowest since 2020) could grow quickly as the company's business (organ care) is slowly becoming an industry standard and these services will be in increasing demand in the future.

Thus, the company is rewarded for its business of helping other people in the form of share price growth in recent years. Over the last 2 years, the stock has gained over 450% in value. However, the last 2 months have seen the share price drop quite quickly from new highs despite the company still reporting good results that are above analysts' estimates. The price has already written off 45% from its peak, which was at the psychological $100 per share level.

Medpace $MEDP

Medpace is a global company specializing in drug development and clinical research services for pharmaceutical and biotechnology companies. It was founded in 1992 and is headquartered in Cincinnati. Medpace has offices and affiliates around the world to help spread the company's good name.

$MEDP is the only company in its industry to have stable double-digit profit margins. Even better, this superior profitability comes along with annual revenue growth of 26% over the past five years. With business consulting firm Grand View Research predicting that the U.S. biotech industry will grow 12% annually through 2030, Medpace might not see a major downturn anytime soon.

With revenue up 31% and backlog up 19% in the most recent quarter, the company continues to dominate its industry. That will be one of the reasons why its stock is up 200% over the past three years even as it has been writing off some of its gains in recent weeks. However, it is still above the important support level of $240 per share.

The company continues to beat estimates, and not just by low percentages. The outperformance is, of course, pleasing stock holders, so it's no surprise that after the latest announcements, when the stock fell 7% before the market opened, it ended the week with a gain of over 4%.

Intuitive Surgical $ISRG

Intuitive Surgical is an American company based in California. It was founded in 1995 and is best known for its contributions in the field of surgical robotics. The company specializes in the development, manufacture and sale of surgical robotic systems and associated surgical equipment.

Importantly for investors, thanks to Intuitive's state-of-the-art model, installation of these systems only accounts for 21% of revenue, down from 30% in 2015. The remaining 79% of revenue is made up of the company's tools, accessories, services and operating leases, which generate high recurring revenue and provide the company with years of stability after system installation.

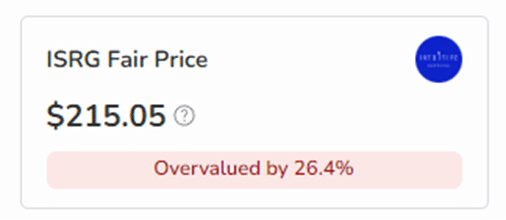

In its most recent quarter, Intuitive saw revenue, earnings per share (EPS) and free cash flow (FCF) grow 15%, 39% and 54%, respectively, while its installed base grew 13%. The company trades at a high price-to-earnings (P/E) ratio of 73.

Thestock price has risen 140% year-to-date since the low in 2020, and it's now off its highs. Over the past month, the price has fallen below $300 per share. So the 2021 peak of $20 after the $400 mark is still not in sight, but this innovative company with very decent earnings is certainly not giving up.

Despite this, however, it is still important to be wary of buying everything that is growing. It's always a good idea to find out the intrinsic value of a company and derive a fair price for the stock. Investors who have become members of the Bulios Black community can now enjoy hundreds of shares with a fair price already calculated.

⚠ You will find a lot of inspiration on Bulios, but the final stock selection and portfolio construction is of course up to you, so always do a thorough analysis on your own. Thepractical tools within the Bulios Blackmembership are always at your disposal.

I have one suggestion for you. Amid recent challenges, certain stocks have shown impressive growth potential. TransMedics, specializing in organ transplantation tech, has surged, driven by sales and revenue growth. At this time, I'm busy with my academic load. I also like stock exchange trading. Hopefully, I will become a prominent trader in stocks someday, but I need personal finance assignment help https://bestassignmentwriter.co.uk/personal-finance-assignment-help.php in the UK. Someone knows this topic, so please let me know.

<a href="https://www.stockmarketnewstoday.com">Stock Market News Today </a>