Have you ever thought about how different restaurant experiences can contribute to your portfolio? The company analyzed today not only specializes in exclusive dining experiences, but also offers stable dividends for investors looking for reliable sources of income.

With its diverse portfolio of culinary brands, this company is able to continually innovate and adapt to changing market conditions, making it an attractive choice for dividend investors.

Company introduction

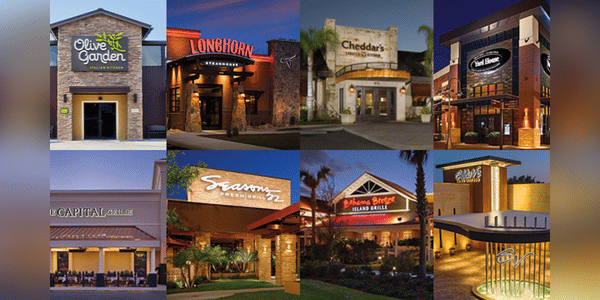

Darden Restaurants $DRI is a major U.S. multi-brand restaurant operator based in Orlando, Florida. The company was founded in 1968 and has since grown into a leader in the full-service restaurant industry. Darden owns and operates several well-known restaurants, including Olive Garden, LongHorn Steakhouse, Cheddar's Scratch Kitchen, Yard House, Ruth's Chris, The Capital Grille, Seasons 52, Bahama Breeze and Eddie V's.

This diversity of brands allows Darden to offer a variety of cuisines and dining experiences, catering to…