The 3 most significant stocks in the flying car market

The flying car market is seeing incredible growth. Its value is expected to grow from $0.42 billion in 2022 to $5.28 billion by 2030, at a compound annual growth rate (CAGR) of 43.7%. This boom is driven by rising purchasing power, changing lifestyles, urban transportation, and population growth. But what is the true potential of flying cars and which companies are leading this innovative market?

The reasons for the growth of the flying car market

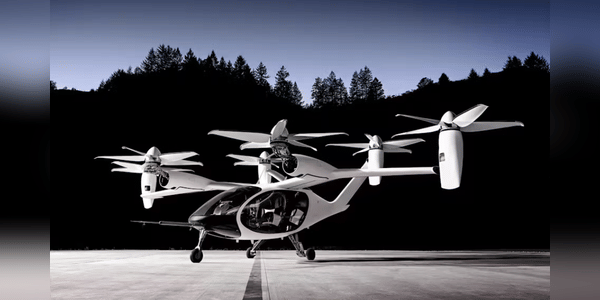

One of the key factors contributing to the growth of the flying car market is the growing emphasis on sustainability. According to a 2021 IBM survey, 77% of respondents prefer sustainable solutions, while only 1% see electric cars as a viable option for everyday use. Flying cars, using vertical take-off and landing (VTOL) technology, offer a greener alternative, especially for longer journeys.

Current transport issues

Road and rail transport face congestion and constraints in urban areas, while water transport is more suitable for long-distance…