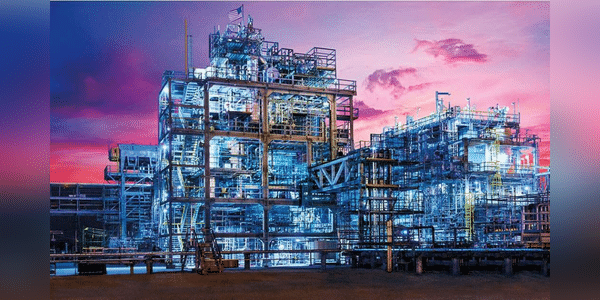

Exxon Mobil Corp, a major US oil and gas company, has decided to sell its Malaysian operations to state-owned energy firm Petronas. The move will see Exxon Mobil definitively withdraw from the Malaysian upstream sector where it once dominated. According to sources close to the situation, the move is part of a broader strategy to target oil production in the Americas.

History and context

Exxon Mobil $XOM has operated in Malaysia for 130 years, during which time it has become a key player in the market. However, the company has been looking to sell its aging assets in the country since 2020, which is in line with its strategy of shifting its focus to the Americas. Petronas, Malaysia's state-owned energy firm, has now taken over Exxon's operations, including the major Tapis oil field in Terengganu, which began production in 1978.

Details of the transaction

Although terms of the deal were not immediately disclosed, sources confirmed that Exxon employees will be transferred to Petronas.…