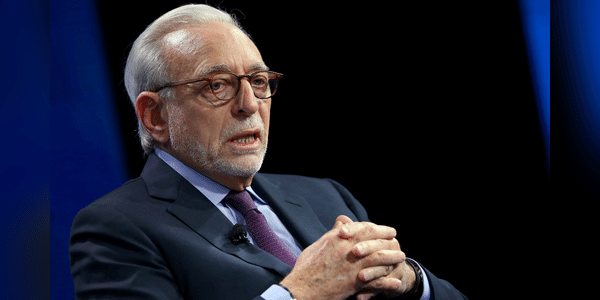

Activist investor Nelson Peltz acquires stake in 3M subsidiary

Nelson Peltz, a well-known activist investor, through his investment firm Trian Fund Management, has acquired a stake in Solventum Corp., which was formed as a separate public company after a spin-off from 3M Co.

Trian thus became one of the largest shareholders in the company, which currently has a market value of about $9.4 billion, a Trian representative said in an emailed statement, confirming a Bloomberg report. The size of the stake that Trian owns has not yet been specified.

Trian, based in New York, has reached out to Solventum to discuss ways to increase shareholder value. The activist investor believes the company should re-accelerate organic growth, restore margins and consider simplifying its portfolio through asset sales, Trian said.

"Trian looks forward to a constructive dialogue with Solventum's management and board of directors," the statement said.

According to informed sources who wished to remain anonymous, Trian believes the proposed changes will allow the company to…