Another close presidential election is imminent and investors should already start thinking about where the best opportunities may lie, depending on which US presidential candidate wins.

Which two stocks are likely to soar if the Democrats hold the White House?

Brookfield Renewable $BEPC

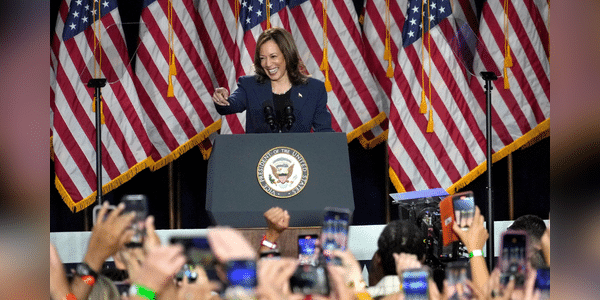

Kamala Harris has a long history of supporting measures to combat climate change. She has already won the support of several groups supporting renewable energy.

As a result, analysts believe that renewable energy stocks in general will see a nice uptick if Harris beats Trump. And Brookfield Renewable is expected to be among the biggest winners.

Brookfield Renewable operates hydro, wind, solar and distributed energy and storage facilities in more than 20 countries. Its current operating capacity is 32,500 megawatts. The company's development plan could add another 157,000 megawatts of capacity.

Analysts think Brookfield Renewable will deliver solid returns over the long term, even if Harris doesn't win.…