Recent results from Imperial Oil have beaten the market consensus. However, it has not yet been enough to reach a new peak. Does the company have what it takes to get above $75 per share and break its current price record?

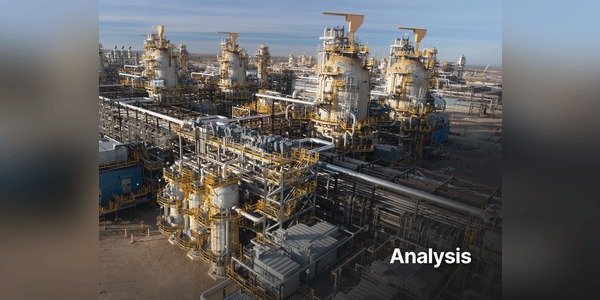

Imperial Oil Limited owns and operates several refineries, including those in Sarnia, Strathcona and Nanticoke. The company is also a major player in the oil sands, specifically the Kearl project, which is one of the largest oil sands projects of its kind in the world. In addition, Imperial Oil is engaged in the production of conventional oil and gas in various locations across Canada.

The company $IMO is known for its Esso brand, under which it sells its products, such as fuels and lubricants, to consumers across the country. Imperial Oil Limited is a subsidiary of ExxonMobil, which owns approximately 69.6% of its shares. This affiliation with one of the world's largest oil giants allows Imperial Oil to benefit from the technological innovations and global expertise…