Investors looking for regular dividend income will appreciate this energy sector firm. The company analyzed today focuses on sustainable earnings distribution and a long-term dividend policy. With a bi-annual payout and a solid yield, it offers an attractive opportunity for those who prefer stable income. In addition, the company benefits from its key role in energy infrastructure on two continents, which makes it resilient to market fluctuations and supports dividend growth well into the future.

With its stable growth and long-term dividend strategy, the company has established itself as a reliable choice for investors seeking regular income. The history of dividend payments dates back to 2005 and the regular twice-yearly payout ensures an attractive yield.

Company introduction

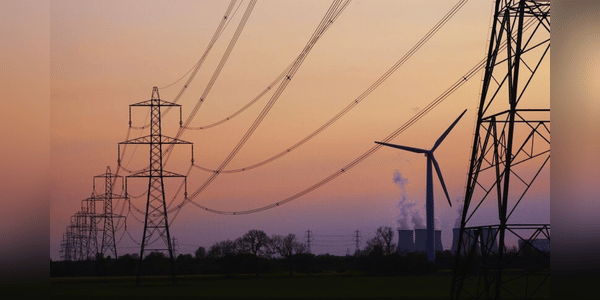

National Grid $NGG is a major energy infrastructure company that specializes in the operation and maintenance of electric and gas utilities. The company's primary focus is the distribution of electricity and…