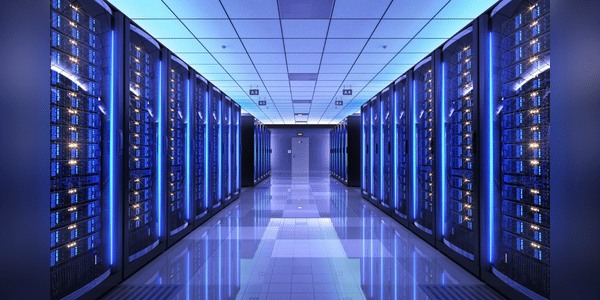

In recent years, one U.S. technology company has emerged as a leader in high-performance networking solutions for data center and cloud applications. With revenue growing 15.9% to $1.69 billion in the second quarter of 2024 and gross margins reaching 64.9%, the company is proving that its innovative approach to software-defined networking and cloud services really works. The collaboration with NVIDIA, focusing on the integration of artificial intelligence into its products, strengthens its competitiveness and opens up new markets.

The company's history and growth are underpinned by strategic acquisitions and a strong focus on emerging markets where demand for cloud services is high. Its average earnings per share (EPS) growth is 34.1% and is expected to grow by another 18.9% this year, well ahead of the industry average.

Company performance

Arista Networks $ANET is an American technology company based in Menlo Park, California, founded in 2004 by former Cisco engineers. It specializes in…