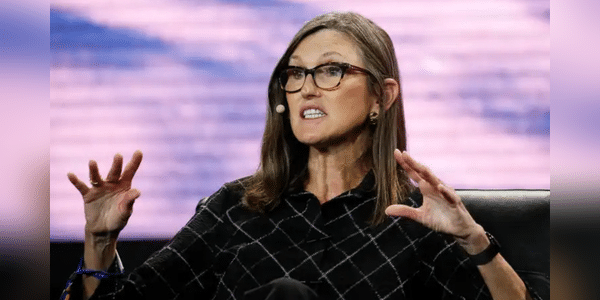

3 stocks that Cathie Wood is adding to its portfolio

Cathie Wood, well-known investor and founder of Ark Invest, still believes in the potential of her favorite tech stocks. Her growth-focused funds are starting to show positive results in 2024, although they are not yet outperforming the overall market. Despite these challenges, Wood continues to build on her existing positions, recently increasing her investments in 3 companies.

Despite the overall market uncertainty, Cathie Wood continues to believe that investing in innovative technology is key to achieving long-term growth. Its funds continue to focus on companies that represent the future and have the ability to revolutionise various industries. Which companies does it trust most at the moment?

Shopify $SHOP

Shares of Shopify, a Canadian e-commerce solutions provider, have risen more than 60% since this summer, and Wood has welcomed the rebound with another purchase. Shopify provides a platform for businesses to create and manage online stores, making it a key player in the digital…