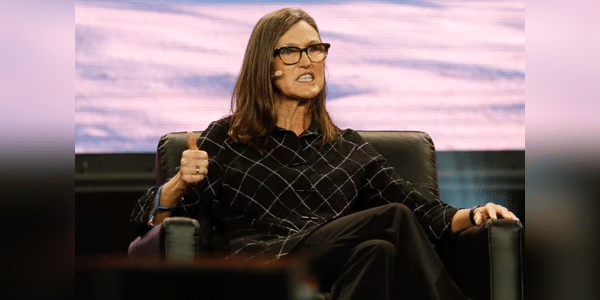

Cathie Wood, a well-known investor focused on aggressive growth strategies, is once again attracting attention with her bold moves. The founder, CEO and manager of investment firm Ark Invest may not be enjoying the same success of late as she did four years ago, but her market activity has been steady and intense.

This week, Cathie Wood increased her stake in Amazon, Ibotta a Teradyne. Let's take a closer look at these three stocks that have now been added to Ark Invest's portfolio.

Amazon: a giant step towards AI dominance

Amazon $AMZN, a leader in e-commerce, continues to see steady sales growth and demonstrate its ability to innovate. It recently announced an expanded investment in artificial intelligence (AI)-focused start-up Anthropic. The move will strengthen its cloud platform AWS, which will become a major partner for training AI models.

Although Amazon stock is up 37% this year, the company faces challenges. Half of its products come from China, making it vulnerable to potential…