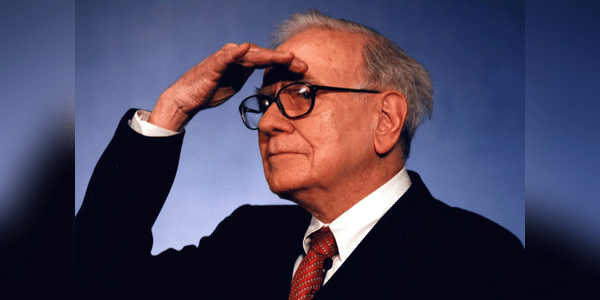

3 Buffett stocks that beat the market this year - will they repeat their success?

Warren Buffett is known for his brilliant investment approach, and his company Berkshire Hathaway has once again outperformed the S&P 500 index. Although Berkshire's stock growth this year is slightly higher than the index, some dividend stocks in his portfolio are experiencing significant growth.

We take a look at three of them that beat the market in 2024. Can they repeat that success in 2025?

American Express $AXP

Buffett has owned American Express (AmEx) stock for decades, a clear indication of his confidence in the company. AmEx is the second-largest position in Berkshire's portfolio and has seen an incredible 58% growth this year.

Although the dividend, with a yield of just 0.96%, isn't staggering, the company's record results make up for that shortfall. AmEx has posted ten consecutive quarters of record revenues, while managing to attract new clients and retain existing ones.

While analysts don't expect AmEx to maintain this year's pace, with a relatively low price-to-earnings ratio…

I have looked at $AXP stock before and have the stock on my watchlist as it would be a good one to add to my portfolio. But the price is too high right now, so I'll wait to buy.