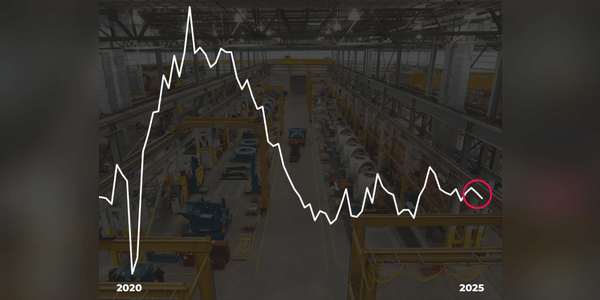

The latest Institute for Supply Management (ISM) survey has just sounded alarm bells for the US manufacturing sector — PMI has dropped to 48.2 %, marking the ninth consecutive month of contraction. With new orders shrinking, production cooling down and employment in factories under pressure, this isn’t just a worrisome number. It’s a red flag for global supply chains, corporate profits and investor sentiment heading into 2026. In our in-depth breakdown, we explore why this emerging weakness could reshape equity, bond and currency markets in the coming quarters — and which sectors may surprise with strength despite the downturn.

At first glance, the November ISM Manufacturing PMI report looks like just another macro number that will fly through the headlines and be replaced by something new in a few hours. In reality, however, this figure is much more than that. It is one of the most sensitive thermometers of the US economy, telling us quite accurately what shape the industry is in, what…