Fresh unemployment data in the United States has brought a new boost of optimism to the market, but also a wave of questions. Jobless claims fell to three-year lows, which in conventional models would imply solid consumer demand fundamentals and stable corporate profits. But in the current economic environment, it's not that simple. Investors have to consider whether low claims really mean a strong labor market or just reflect a short-term seasonal distortion. It is this dilemma that will determine how the S&P 500 reacts in the weeks ahead.

The evolution of jobless claims from 2022

Analysis of current data

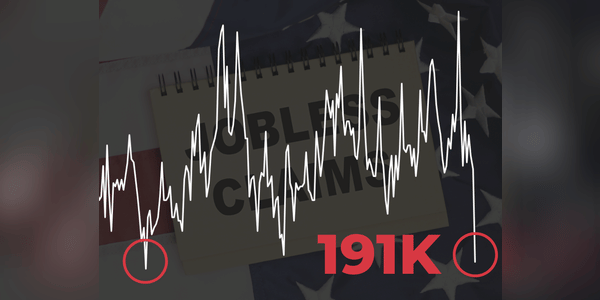

The most recently released data on new jobless claims in the United States provided an unexpectedly strong boost to the markets. The value of claims fell to 191,000, the lowest level recorded since September 2022. This result exceeded the expectations of analysts, who had been counting on values of around 220,000. Investor reaction was immediate, although a one-off figure may not tell…