Will any company succeed in dethroning Tesla from the EV throne? Companies like NIO, Lucid, Xpeng, General Motors, Ford Motor, and Rivian are trying to do it. The question is, will any of them succeed or is the lead no longer achievable? Well-known names like Ray Dalio and David Einhorn are clear on this and are turning their attention to one of the aforementioned EV companies.

A look at an interesting EV Stock - Rivian.

The question is whether anyone will ever succeed in unseating Tesla, but if we are to believe it or want to see it happen it is good to look at what people with more information believe. Of some interest is that the aforementioned hedge fund managers Ray Dalio and David Einhorn acquired $4 million worth of Rivian $RIVN stock last quarter, I'm not saying that's some huge stake but it's certainly worth paying attention to.

A brief definition of $RIVN

Rivian Automotive, Inc. designs, develops, manufactures and markets electric vehicles and accessories. The company offers five-seat pickup trucks and sport utility vehicles. It provides the Rivian Commercial Vehicle platform for electric vans in partnership with Amazon.com. The company sells its products directly to customers in the consumer and commercial markets. Rivian Automotive, Inc. was founded in 2009 and is headquartered in San Jose, California.

The company is widely regarded as one of the most technologically advanced and promising electric vehicle manufacturers in the world. Rivian is meeting its revised supply and production goals, even in a bad market that is now prevalent in conjunction with a shortage of semiconductors and various types of commodities. Some analysts believe that Rivian has what it takes to become one of the world's most valuable EV manufacturers by 2030.

Rivian's R1T

In 2021, Rivian started deliveries of its first model, the R1T. The R1T is an electric pick-up truck that seats five and can travel approximately 450-480 kilometers on a single charge, it also boasts an interesting acceleration time of 0-100 km/h in about 3 seconds, which is a really interesting number for a pick-up truck. This is a very high quality electric pick-up. And it currently starts at $73,000. Rivian has delivered nearly 1,000 of these trucks in 2021 and is on track to deliver more than 20,000 R1Ts this year.

https://www.youtube.com/watch?v=0BmG0ZlnmHE&ab_channel=ThrottleHouse Interesting review video on the R1T.

They are diversifying their portfolio of course and their next model is an electric SUV model - the R1S. It's a large SUV that comfortably seats up to seven passengers and their gear. It has a range of around 480-500 km on a single charge and the acceleration from 0-100 km/h is, like the R1T, something around 3 seconds. It has the option of all-wheel drive and is equipped with the same interior features as the R1T. Deliveries of the R1S have barely begun, with the company supplying models to employees only for now. Public sales are expected to begin soon. Estimated selling price starts somewhere around $72/3,000, similar to the fellow.

https://www.youtube.com/watch?v=ktZyl525zIo&ab_channel=KelleyBlueBook

Also an interesting review video and opinions on the R1S model.

Predictions for the Rivian

Over the long term, analysts believe that quality EV stocks are great multi-year investments. Indeed, EVs will grow from about 10% of today's car sales to 50% plus by 2030 /such are the estimates/. As the entire industry grows 5x, companies at the forefront of this industry will sell a lot of cars, make a lot of profits, and create a lot of shareholder value. Analysts also estimate that some of the biggest winners in the stock market over the next decade will be EV companies, which may include Rivian, which is subject to these bullish fundamentals:

- Rivian is building a leadership position in the strong demand-driven and fast-growing EV sector. The gap in the larger car market is very large with very resilient and strong demand drivers. Arguably, as this part of the automotive market electrifies, an equally large market and demand for larger EVs will emerge. At the moment there is no clear leader in this market. But Rivian is off to a promising early start with a fantastic first-to-market truck that has some of the best specs in the industry.

- The strong technology behind Rivian. Rivian has built an exceptional luxury brand and developed cutting-edge battery and torque technology for electric vehicles. These are two things that are critical to creating a great electric utility vehicle. In fact, the R1T is arguably the most powerful electric pick-up on the market today and should remain so for the foreseeable future.

- Demand for the Rivian models is marked by a figure of over 90,000 pre-orders for the R1S and R1T, proving that consumers want these cars.

- Rivian also has a very unique and promising partnership with Amazon. The retail giant will purchase at least 100,000 electric vans from Rivian.

https://www.youtube.com/watch?v=BAb0ZeJUtIY&ab_channel=CNBCTelevision There's been a really interesting collaboration between Amazon and Rivian, and what's clear is that this collaboration may continue to expand. Amazon has essentially chosen Rivian as its "horse" in the EV race. It will convert its entire fleet to Rivian cars on a large scale. This represents a huge long-term opportunity for the company.

- In terms of cash, it is also doing quite well and has nearly $20 billion in cash on its balance sheet. This cash gives the company an almost unfair competitive advantage over its "industry" peers. And this cash is to be used by Rivian to expand its technology base, as they intend to invest this money in the coming years to develop cutting edge technology and secure market leading supply agreements and establish market leading manufacturing capability, which is very important. Having $20 billion at its disposal may allow the company to establish a really interesting position in the EV industry over the next few years.

Conspiracy math

Rivian could reach the milestone of millions of shipments per year by the end of this decade. At an average selling price of $70,000, that translates to total revenues of $70 billion. Assuming a similar margin profile to Tesla - 30% gross margin and 20% operating margin - this would result in an operating profit of $14 billion. Net profit after tax is approximately $10 billion. A simple 20X price-to-earnings (P/E) multiple implies a potential Rivian valuation target of $200 billion by the end of this decade . That's nearly 10X the current market capitalization, meaning Rivian stock could be a potential 10X.

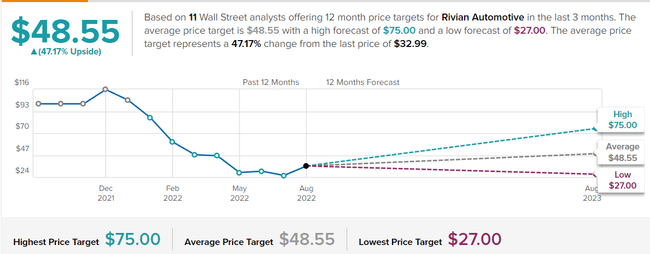

TipRanks Source.

From the chart we can see that based on the prediction of 11 analysts, the median price of Rivian stock is at $48. As for the rating, 7 of them gave it a BUY status, 3 HOLD and 1 SELL.

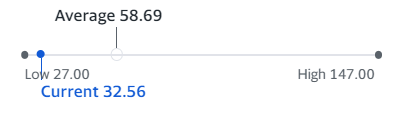

Source: Yahoo.Finance

We can also see an interesting rating from Yahoo.Finance, where analysts have set the median price at $59, which is a really nice increase from the current price, and they have set the upper limit as high as $147.

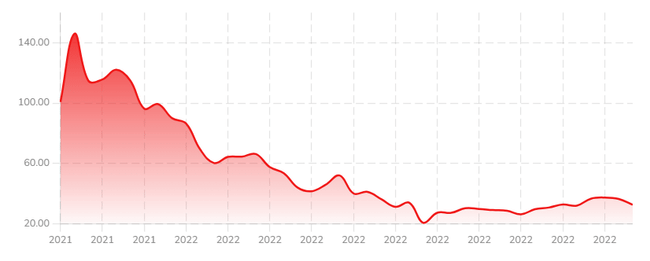

Source.

As we can see from the chart, the current price is really interesting at the current value, as the HIGH is up to somewhere 140-150 USD, but that was due to the listing of course, but the LOW is somewhere at 22-23 USD and therefore I would consider the current price as quite interesting and if you are thinking to invest, I would not be afraid to invest a third or half of the position now.

https://www.youtube.com/watch?v=MXixiiarcJc&ab_channel=BenSullins

If you want to know even more about Rivian, here I attach an interesting review with user reviews.

For me this is definitely an interesting company that is really low from ATH and thus the current price is quite interesting, I would definitely go DCA as we have an uncertain market and it may still fall. What's definitely bullish - the Amazon collaboration and the fact that they're investing interesting names like Ray Dalio and David Einhorn and their funds are doing well and they have a lot of data. However, this is just my opinion and not investment advice, so definitely do your own research before investing.

If you like this post, I'd be happy for a comment and a follow :)

nice info

kanda ahh