Today, I would like to focus on Komerční banka shares, which have been frequently mentioned recently in connection with buying at a significant discount. KB presented us with its quarterly results in August, which are good and satisfactory beyond measure. So why are KB shares actually falling? Is this a brilliant opportunity for a bargain investment?

Basics and introductions 👇

Komerční banka is a banking institution operating on the Czech capital market majority owned by the French financial group Société Générale. It is a joint stock company and its shares are tradable on the Prague Stock Exchange. Komerční banka provides financial products and services for citizens, entrepreneurs, small and large enterprises and the state administration.

How was KB'squarter ?

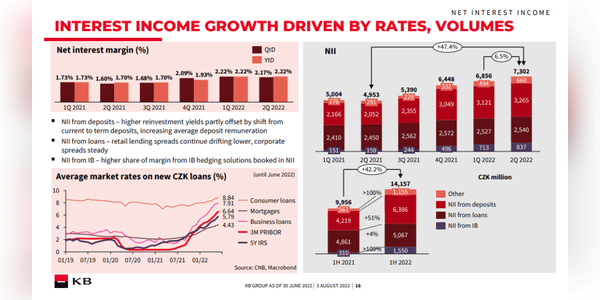

Komerční banka's shares continued to dominate in the second quarter of this year. The driving force was none other than rising interest rates.

The graphic is taken directly from KB's presentation.

KB reported the following for the…