In the first half of the year, everyone was panicking about the bear market, then it looked like the market had gone through its ordeal and we would be back in the green numbers. But that started to turn around as the end of the holiday season approached and now the mood is becoming very skeptical again. Below, we'll take a look at 2 indicators that tell us what we should be preparing for.

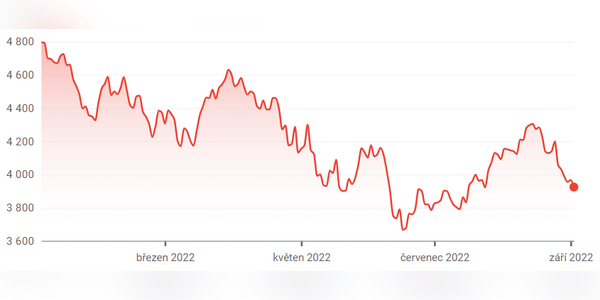

There are a number of reasons to panic, although a lot has been written about them, but it seems to me that they are quickly being forgotten again. Inflation, interest rates, the energy crisis, the tense geopolitical situation due to the war in Ukraine, and the risks of war in Taiwan. In addition, the S&P 500 $^GSPC index closed in negative percentages for the third consecutive week this past Friday, and is now down slightly over 17% from the start of the year.

1. Forward PE ratio of the S&P 500 index

This metric is calculated by dividing the aggregate point…

how am I good at trading, stocks, choosing a classy broker

Please help me

how am I good at trading, stocks, choosing a classy broker

Please help me

I Like Your Post.

I Like Your Post.

I Like Your Post.

I Like Your Post.

I Like Your Post.I Like Your Post.