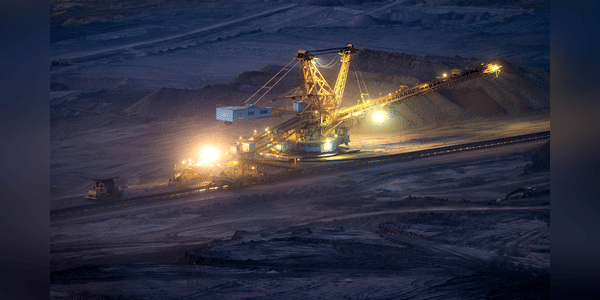

The rising price of oil and gas is now being followed by coal. It has even reached a record price per tonne at the Australian port of Newcastle, a hub in the distribution of coal around the world. Logically, miners have benefited and will benefit even more. Let's take a look at 3 specific mining company stocks.

The coal price is driven by high demand, which is mainly coming from coal-fired power stations. Their production is needed now more than ever, given the severe energy crisis Europe is in. In addition to demand, the disruption of mining in Australian mines, a key global supplier, is playing a significant role in the coal price. This may be due to weather fluctuations, especially the excessive rainfall generated by La Nina.

In some previous La Nina seasons, coal mines and railways in the Australian states of New South Wales and Queensland have been disrupted by heavy rainfall, and during particularly bad weather that lasted for several months in 2010 and 2011, production fell by an…

how am I good at trading, stocks, choosing a classy broker

Please help me