Legendary investor Warren Buffett probably needs no introduction. His genius and investment wisdom has helped him and his Berkshire Hathaway to beat the performance of the S&P 500 over the long term, which just about anyone can do. Today, we'll look at a few of his basic strategies and ideas that can help you too to improve your performance and beat the S&P500.

Warren Buffett (Oracle of Omaha)

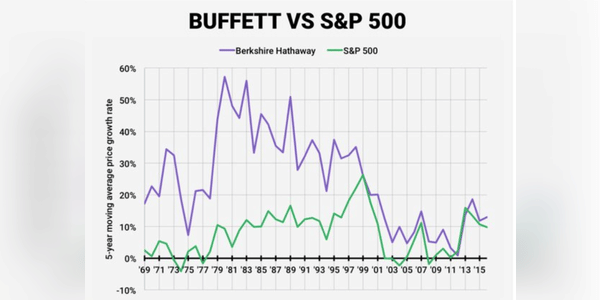

We all know the good old fable surrounding the great man's name, which is that Buffett has been beating the S&P 500 index for a long time. Better put - Buffett and his Berkshire have generated a compound annual return of 20.1% (since 1965) versus 10.5% for the S&P 500. This year, that return may not be as great, but that's due to the size of his Berkshire and not finding as many lucrative investments, plus macroeconomic influences.

As you can see, the curve is slowly approaching the performance of the S&P 500, but it is still slightly above it. The chart is only through 2015, but it's pretty similar…

how am I good at trading, stocks, choosing a classy broker

Please help me