Stocks are going through tough times in 2022, so it's a good idea to look for companies that are not susceptible to the economic cycle and have a long history of paying dividends. Here, we'll focus on 3 companies that have increased their dividend payout year after year for at least 25 years. We could therefore label them as dividend aristocrats.

Realty Income

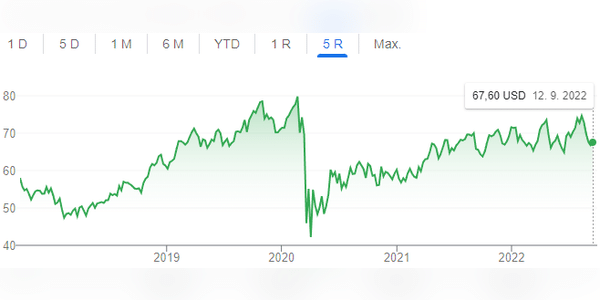

Realty Income $O is a real estate investment trust with a portfolio of more than 11,000 properties that are leased under long-term leases with commercial tenants. Realty Income's major tenants include big names like Walmart, CVS Pharmacy and Walgreens - companies that have weathered multiple economic cycles. It is this diversified and high-quality tenant base that allows Realty Income to pay reliable dividends.

One of the company's advantages is its monthly dividend distribution policy. While most dividend aristocrats pay quarterly dividends, Realty…

how am I good at trading, stocks, choosing a classy broker

Please help me