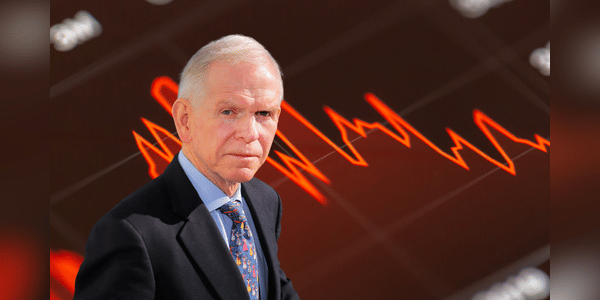

The spring was marked by the massacre of the market. The summer, on the other hand, was relatively calm and unexpectedly green. Now, however, everyone is nervously awaiting the autumn events, which many believe will once again mean somewhat turbulent times. Well-known investor Jeremy Grantham has said that the "superbubble" he previously warned about has not yet burst, even after the spring slumps.

The co-founder of Boston-based asset manager GMO, who has made a point of warning about market bubbles, said in a note on Wednesday that the sharp rise in US stocks from mid-June to mid-August fits the pattern of bear markets. Such a pattern is said to be common. A sharp decline (spring), a modest rebound and rise (summer), and then comes the grand finale in the form of a supercrash.

All of this, according to Grantham, is fed by a lethal combination of overvalued stocks, bonds and housing combined with a commodity shock and a hawkish Federal Reserve…

how am I good at trading, stocks, choosing a classy broker

Please help me