Today I would like to follow up on my previous article that was a success last week. I analyzed how Warren Buffett's above-average performance garnered positive feedback. Today, I would like to follow up on that and look at the specific criteria or parameters that the great man uses to select individual stocks.

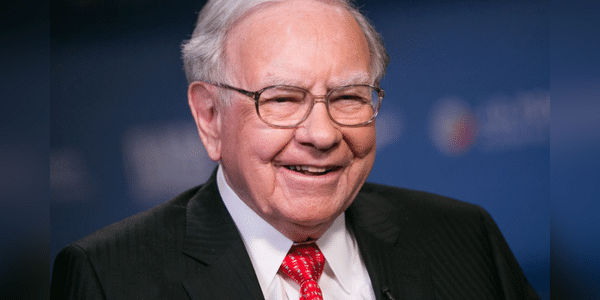

Warren Buffett (Oracle of Omaha)

Warren Buffett, the legend, the genius or the oracle, this is how this great man is often referred to, who has really achieved a lot in his career. Investors should never blindly follow or copy someone's actions, but in this case, it is the case that we can learn a lot by watching his actions, advice, statements, etc. From the previous article, you know how Buffett picks individual companies and what they must meet as a guide 👇

How to achieve the average annual return of 20% achieved by Warren Buffett?

Today, however, we'll focus on the specific numbers Buffett requires to even consider a potential investment. The Oracle of Omaha is rightfully…

Saved this later reading.

how am I good at trading, stocks, choosing a classy broker

Please help me