Are you still worried about a market crash? Take Warren Buffett's advice and invest in these 3 companies

Every day there are various reports coming out about how this is just the beginning and the crash is yet to come. Whether this is true and we are really in for a big crash is very hard to predict, but one thing is true, the market is already pretty low and some companies are already at attractive levels. For investors who regularly invest and average their positions, this article can be very helpful as it is based on the investment steps of one of the most famous investors in the world who has already survived and profited from several market crashes.

Warren Buffett recommends investing in these 3 companies.

What is his advice?

It's pretty simple, the Oracle of Omaha recommends investing in America. Warren is clear on this, even during the early stages of the pandemic Buffett stated that "basically nothing can stop America." And it's true that many American companies have weathered the pandemic and are still great buys today. So how can you invest in America following Buffett's advice?

1. Seagen $SGEN

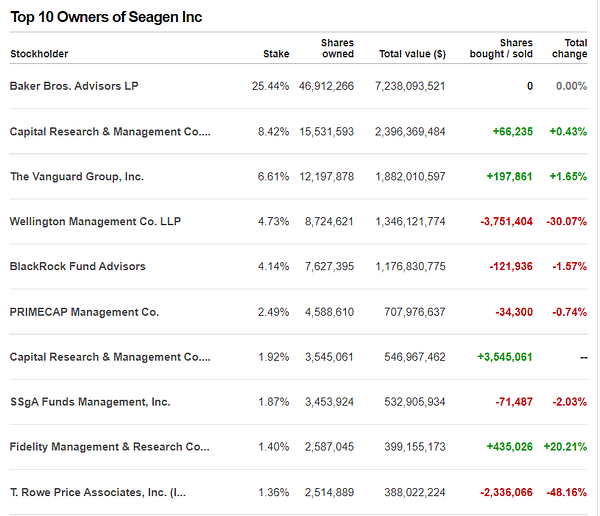

Seagen Inc, a biotechnology company, develops and commercializes therapies to treat cancer in the United States and internationally. The company offers ADCETRIS, an antibody-drug conjugate (ADC) to treat patients with Hodgkin's lymphoma or CD30-positive T-cell lymphomas. It is also developing TIVDAK for metastatic cervical cancer and other tumors. The company also has some important collaboration agreements with renowned pharma companies. Washington-based Seagen may not be a typical Buffett stock, as biotech is not an area he would normally pursue in his portfolio. But Seagen 's pursuit of cancer-fighting drugs and its ability to bring multiple products to market are reasons why it could be a solid healthcare company that could deliver nice profits in the future, even if they're loss-making now. The loss for last year is around 700 million. But the reason the stock deserves an exception for value-oriented investors is that Seagen's gross profit margin is an impressive 80% of revenue.

The company is seeing nice year-over-year sales increases - 25%, and that's from product sales.

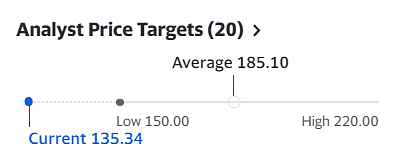

Source: Yahoo.Finance

As we can see, based on a forecast of 20 Wall Street analysts, the median price for this company is $185, which is a solid increase from the current price of $135. Also, analysts have taken a stance with a BUY rating.

2. Coca Cola $KO

Coca Cola probably won't surprise anyone among Buffett's picks, but it's still basically a currently attractive company that hasn't been shaken by a pandemic and is still basically holding steady. I'm not going to specifically introduce this company, as we all know they are focused primarily on soft drinks. Coca Cola sells their products under the brands of Coca-Cola, Diet Coke/Coca-Cola Light, Coca-Cola Zero Sugar, Fanta, Fresca, Schweppes, Sprite and many more. It operates through a network of independent bottling partners, distributors, wholesalers and retailers, as well as through bottle operators and distribution. Beverages include coffee, vegetable juices, water and flavored alcoholic beverages in addition to soft drinks.

The company is a good and safe option to invest in because its products are a staple in households and will be in demand no matter how the economy fares. Despite challenging macroeconomic conditions, including supply chain issues and rising inflation, the company delivered solid second-quarter results in July, with sales of $11.3 billion up 12% year-over-year.

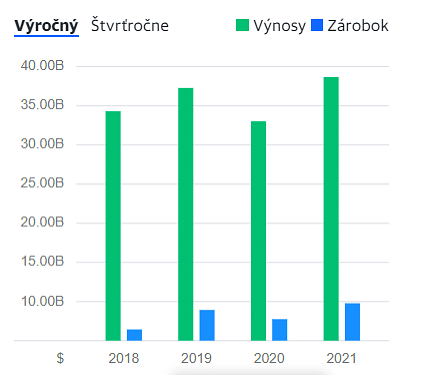

Source: Yahoo.Finance

As we can see from the chart, Coca-Cola is a cash-rich business that generated free cash flow of $10.2 billion over the past 12 months, which is more than enough to cover the $7.4 billion dividend during that time frame. The company is defined, as a Dividend King that has increased its payout for 60 consecutive years and pays a current 3%.

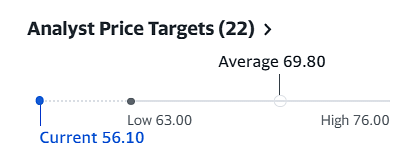

Source: Yahoo.Finance

As we can see 22 Wall Street analysts have set the median price at $70, which is quite a nice increase from the current price of $56. They also defined BUY status.

3. Tmobile USA $TMUS

T-Mobile US, Inc. along with its subsidiaries, provides mobile communications services in the United States, Puerto Rico and the U.S. Virgin Islands. It also provides wireless devices, including smartphones, wearables, tablets, and other mobile communications devices, as well as wireless devices and accessories. In addition, the company offers services, devices, and accessories under the T-Mobile and Metro by T-Mobile brands through its owned and operated retail stores, T-Mobile app and customer care channels, and its website.

T-Mobile is a premier telecommunications company with headquarters outside of Washington. While it does not provide dividends like other telecom stocks, it does repurchase shares, which can help boost the stock price and lead to gains for shareholders. This month, it announced a share buyback program that could allow it to buy back up to $14 billion worth of shares within a year. And that's likely to be just the beginning, as the company previously said it plans to buy back up to $60 billion of shares between 2023 and 2025, which I consider a really bullish signal. The company claims that its 5G network now covers nearly the entire country and offers more coverage than its competitors, AT&T and Verizon Communications combined.

Buffett clearly knows what he's doing, as evidenced by the fact that T-mobile is setting records in billings additions.

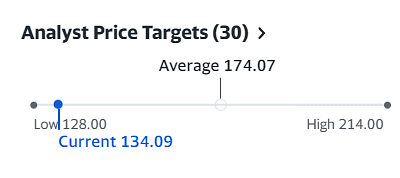

Source: Yahoo.Finance

As we can see, T-mobile, like the companies analyzed above, is well below the median value, as defined by Wall Street analysts, of $174. They also defined a clear BUY status.

As for investing according to Warren Buffett, we certainly can't question that too much he has been proving for years that he knows how to do it and is doing it above average. Betting on America is the right choice in his view, which I do not think is any better than betting on Europe. So if you're the type of investor who invests regularly and has spare cash, I would definitely consider this list, but don't take it as investment advice, just analysis from a retail investor.