I haven't brought you an interesting stock pick with high potential in a while. Today, however, I'm going to remedy that and take a look at a company that has the potential for 350% growth. The company is very well positioned to see this prediction come to fruition, as it has undergone a number of significant partnerships and its products are considered key to the future of Europe.

Today's article will focus on $FREY Battery $FREY.

What is the company's business?

The company specialises in the production of materials needed for the manufacture of battery cells. It also sells batteries and battery cells to markets that include electric vehicles and energy storage systems for marine and aviation.

FREYR could see tremendous growth, which in a way it already is, but analysts say this is just the beginning of a long ride where Freyr will eventually end up much higher.

Why should the company continue to show strong growth?

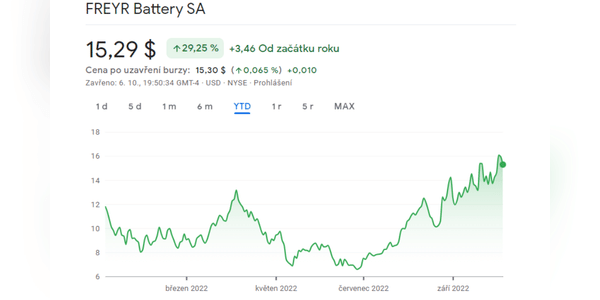

Shares of $FREY have gained a total of 73.75% since going public (2021).

Ana…

Good Information