All kinds of negative influences are shaking the market. Analysts, experts and investors are racing to see which one will come up with the more accurate catastrophic scenario. But now one of the biggest skeptics has sprung a surprise. He claims the opposite!

Negative thoughts and attitudes have already fallen on almost everyone this year. But now one of the biggest doomsayers has done a 180.

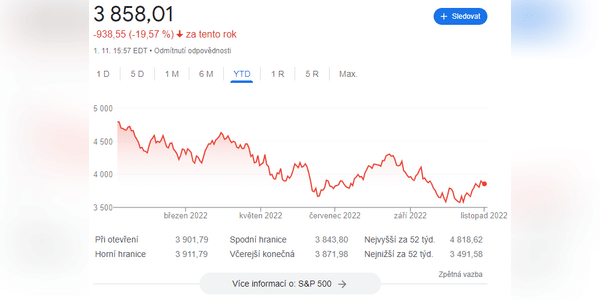

Mike Wilson of Morgan Stanley, a well-known stock market skeptic who correctly predicted this year's downturn, believes the bear market in U.S. stocks may be over sooner than investors think.

"We think that ultimately the bear market will probably end sometime in the first quarter of next year," Wilson said in an interview with Bloomberg Television. I want to be clear that if the market starts trading again and the S&P 500 breaks the 3,650 level to the downside, we'll be bearish again."

One Of The Best Thing..thank

Hubo un tiempo hace años en que las únicas personas que podían comerciar activamente en el mercado de valores eran las que trabajaban para grandes instituciones financieras, casas de bolsa y casas comerciales. La llegada del comercio en línea, junto con la difusión instantánea de noticias, ha nivelado el campo de juego, o deberíamos decir comercio. Las aplicaciones comerciales fáciles de usar y el 0% de comisiones de servicios como Robinhood, TD Ameritrade y Charles Schwab han hecho que sea más fácil que nunca para los inversores minoristas intentar operar como los profesionales.

great

This Good Information, Thank's!!!

Meta’s stock rose about 4% in premarket trading on Wednesday after Meta announced the layoffs and was up more than 7% as of 11:25am EDT. The stock has fallen 70% on the year on concern about the company’s spending and weak earnings. It fell to its lowest since 2016 last Thursday, wiping out more than $89 billion of market value, after reporting a drop in revenue in the second quarter.51