The stock market will never be the same again. Now we'll be playing a completely different game, say BlackRock experts

BlackRock is undoubtedly one of the most important companies on Wall Street. Now the giant is making a disturbing announcement. What drastic changes do they think are coming to the market?

The stock market is changing. The rules of the game are changing, say BlackRock officials $BLK

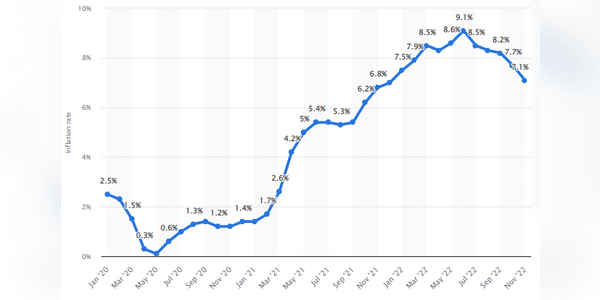

Investment strategists at the world's largest asset manager warned of several factors in their global outlook for 2023, released this week. Chief among them are a looming recession, high, runaway inflation and market fundamentals.

"The 40-year period of mostly stable activity and inflation is over," wrote Vice Chairman Philipp Hildebrand and a team of senior managers. "A new regime of greater macro and market volatility is emerging. Moreover, almost everyone agrees on the arrival of a recession."

Hildebrand and his team argue that that great stability, a period of low inflation and steady economic…

https://communityin.oppo.com/thread/1257017037646725120https://communityin.oppo.com/thread/1257019883783716870https://communityin.oppo.com/thread/1257019890276499461https://communityin.oppo.com/thread/1257019896350113793https://communityin.oppo.com/thread/1257019901584605185https://communityin.oppo.com/thread/1257027661189349382https://communityin.oppo.com/thread/1257028217236881415https://communityin.oppo.com/thread/1257029618385813506https://communityin.oppo.com/user/1257016204397903876

https://communityin.oppo.com/thread/1257024250809155591https://communityin.oppo.com/thread/1257024355155050505https://communityin.oppo.com/thread/1257024863395905541https://communityin.oppo.com/thread/1257025179948417025https://communityin.oppo.com/thread/1257025538007760900https://communityin.oppo.com/thread/1257029650715508742https://communityin.oppo.com/thread/1257029703454949378

https://bulios.com/status/83355-avatar-2-the-way-of-water-2023-fullmovie-online-streaming-for-free-at-homehttps://bulios.com/status/83356-avatar-2-the-way-of-water-2022-yts-torrent-download-yify-movieshttps://bulios.com/status/83357-avatar-2-the-way-of-water-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83358-watch-avatar-2-the-way-of-water-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83354-download-avatar-2-the-way-of-water-2022-full-movie-download-free-720p-480p-and-1080p

https://bulios.com/status/83359-watch-m3gan-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83360-m3gan-2022-yts-torrent-download-yify-moviehttps://bulios.com/status/83361-m3gan-2023-fullmovie-online-streaming-for-free-at-homehttps://bulios.com/status/83362-m3gan-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83363-download-m3gan-2022-full-movie-download-free-720p-480p-and-1080p

https://bulios.com/status/83364-the-legend-of-maula-jatt-2022-yts-torrent-download-yify-moviehttps://bulios.com/status/83365-watch-the-legend-of-maula-jatt-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83366-the-legend-of-maula-jatt-2023-fullmovie-online-streaming-for-free-at-homehttps://bulios.com/status/83367-the-legend-of-maula-jatt-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83368-official-watch-the-legend-of-maula-jatt-full-movies-online-for-free

https://bulios.com/status/83369-babylon-2022-yts-torrent-download-yify-moviehttps://bulios.com/status/83370-watch-babylon-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83371-babylon-2023-fullmovie-online-streaming-for-free-at-homehttps://bulios.com/status/83372-babylon-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83373-download-babylon-2022-full-movie-torrent-download-free-720p-480p-and-1080p

https://bulios.com/status/83374-download-pathaan-2022-full-movie-torrent-download-free-720p-480p-and-1080phttps://bulios.com/status/83375-pathaan-2022-fullmovie-free-online-on-123movieshttps://bulios.com/status/83376-pathaan-2022-yts-torrent-download-yify-movieshttps://bulios.com/status/83377-pathaan-2023-fullmovie-online-streaming-for-free-at-homehttps://bulios.com/status/83378-watch-pathaan-2022-fullmovie-free-online-on-123movies

https://events.ydr.com/event/582f22dd5cde86196591ccd7379b3f2ahttps://events.ydr.com/event/573341f4113336a527af765f08463ebehttps://events.ydr.com/event/356d50ea9c09dff5d88c6c6fdefa586chttps://events.ydr.com/event/c066c2529f223ea4cff6f63314f78ee5https://events.ydr.com/event/0865b749a930290be16a9ff1cf85c69bhttps://events.ydr.com/event/f31348ee5633c663265b8816351a5489https://events.ydr.com/event/69b5a43617fb3a889827b440a4d047bbhttps://events.ydr.com/event/72d1ef690f0d0b66a35aa7b45774367chttps://events.ydr.com/event/5977affb36183b91f68bfb51b84b81dchttps://events.ydr.com/event/52ebad4abd13a616d6f06ea30324bf6b

https://communityin.oppo.com/thread/1257102198744809477https://communityin.oppo.com/thread/1257103344284467203https://communityin.oppo.com/thread/1257103372436635653https://communityin.oppo.com/thread/1257103395740188676https://communityin.oppo.com/thread/1257103417709953026

https://communityin.oppo.com/thread/1257033504483966982https://communityin.oppo.com/thread/1257033538994700292https://communityin.oppo.com/thread/1257033611170545669https://communityin.oppo.com/thread/1257033634935472129https://communityin.oppo.com/thread/1257033653390409734

Is forex hard?

Stocks closed lower Tuesday, giving up earlier gains, as concerns such as rising rates and high inflation that knocked the market down last year continued to trouble investors in the new year.

haseum

why?

good

wow

nice

good

wow