Recession, possible oil price rise again, rate hikes. 2023 is so far bringing only negative influences for investors. How should investors prepare themselves and what should they do?

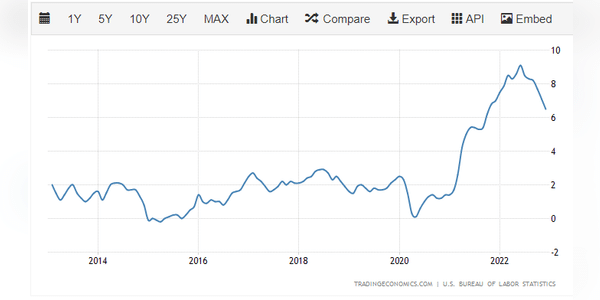

After the S&P 500 index fell by 19% in 2022, investors are rightly concerned about what this year will bring. Inflation is still high, interest rates are still rising, and an economic downturn is a real possibility. How to prepare? What to count on?

It starts with thinking about possible downside scenarios in the near term. The smartest investors are always aware of what factors are most pressing for the markets and the economy at any given time. And what are the biggest risks we face right now? 🤔

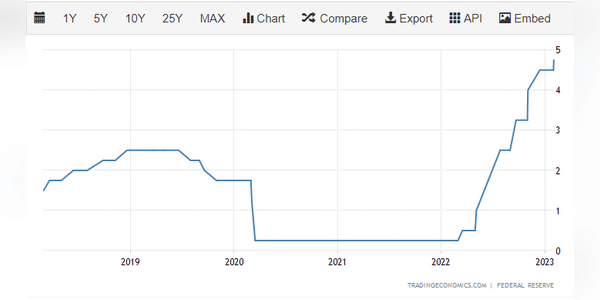

Rates

Almost most important is what the Federal Reserve does. The U.S. Federal Reserve is tasked with not only keeping unemployment low, but also keeping prices in check throughout the economy.