JPMorgan analysts presented 3 picks for stocks that they believe are significantly undervalued. They give a buy rating on all 3, and also present price targets that are quite interesting.

The strong jobs report is going against the Fed's wishes these days. The idea is that if the labor market is still too ''hot'', the Fed will not be interested in easing its tight monetary policy as part of its ongoing efforts to tame inflation. And that's a scenario the market wants to avoid after a series of multiple rate hikes.

But JP Morgan Asset Management chief strategist David Kelly thinks the latest numbers are more flattering than the market thinks, and believes the way the data is reported distorts the reality that there are already interesting opportunities lurking beneath the surface.

Against this backdrop, Kelly's analyst colleagues at the bank are advising investors to lean on a few names that fit a certain profile; they have fallen significantly in price recently, but are prepared to march forward or grow. So this is their pick 👇

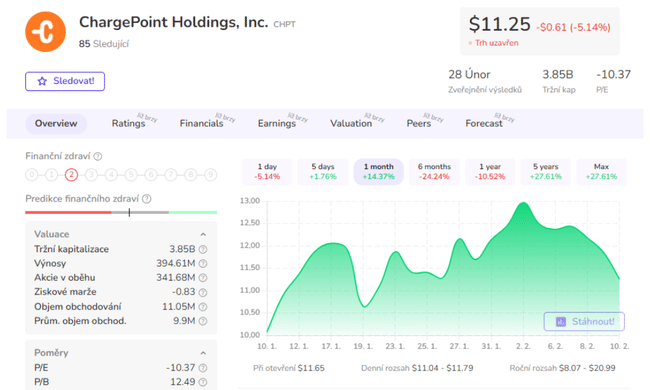

ChargePoint $CHPT

ChargePoint is one of the most prominent companies in the electric vehicle market. It operates one of the largest networks of EV charging stations in the world with a leading position in North America. The company has more than 211,000 charging stations in the US and Europe.

Unfortunately, in the last quarter of fiscal 2023, ChargePoint faced supply chain issues, which negatively impacted its financial results. Even though sales were up 93% from the previous year, the market was not happy with the results and the company's stock fell. However, analyst Bill Peterson of JP Morgan points out the current difficulties and explains why he is still optimistic about ChargePoint. He believes the company has the potential to improve further and achieve positive free cash flow by the end of 2024.

JP Morgan's Bill Peterson, however, points out the current problems but gives reasons to remain bullish despite some concerns 👇

"While supply constraints are generally easing, the company still faces cost headwinds, so full-year margins are now expected to be below expectations (though right in line with our view)," the analyst explained. "However, with operating expenses lagging expectations and ChargePoint providing solid operating leverage, we are increasingly confident that ChargePoint can demonstrate further improvement to be on track for positive free cash flow by the end of 2024."

"We continue to believe that ChargePoint's scale and leadership are underappreciated, as are its software and service offerings, which, while lagging the hyper-growth of connected hardware sales, should accelerate in the coming years. with the growing number of customers," Peterson said. As such, Peterson rates CHPT an Overweight (i.e., Buy) rating along with an $18 price target.

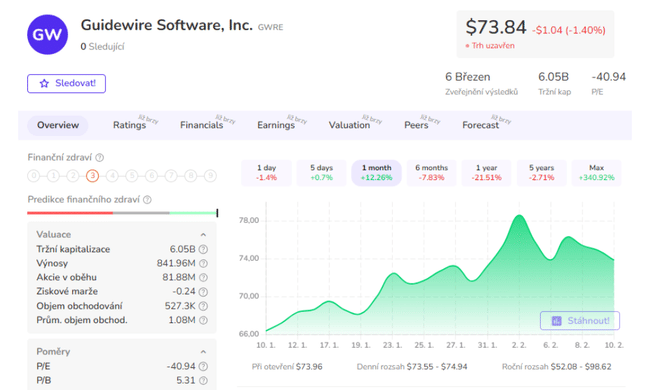

Guidewire Software $GWRE

Guidewire, which specializes in providing core software for the insurance industry, is a leader in the industry's digital transformation. The company is looking to move its customers to its cloud-based platform that covers everything from administration, underwriting and analytics. This market is still undeveloped and thus offers great scope for growth.

In the fourth quarter of fiscal 2022, Guidewire faced concerns about a drop in demand due to the uncertain economic situation, which was reflected in a 48% year-over-year decline in its stock. Despite this, JP Morgan's Alexey Gogolev sees future growth potential for the company. He believes that Guidewire has one of the leading competitive positions, which allows it to lead the software integration and successfully transition to a cloud-based solution for insurance companies. Gogolev estimates that Guidewire could potentially double its revenue by migrating its existing customers to the cloud.

Gogolev suggests buying Guidewire stock with a $78 price tag and estimates the stock could rise 34% over the next 12 months.

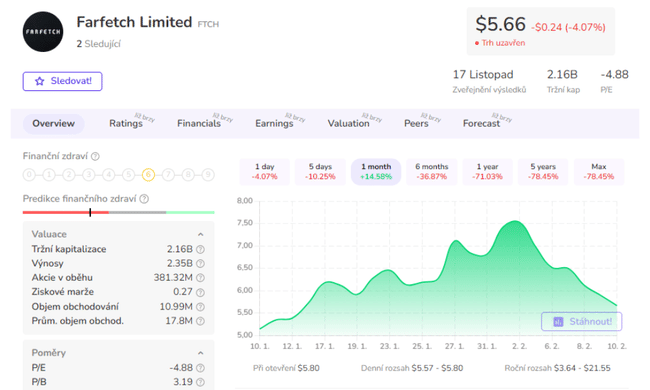

Farfetch Limited $FTCH

Farfetch, a company that sells luxury fashion goods through its online platform with more than 1,400 brands offered, is the latest stock backed by JPMorgan. Headquartered in London, the British-Portuguese business also has offices in New York, LA, Tokyo and Shanghai. Despite the premise that luxury goods are more inflation-proof, Farfetch shares are down 83% in a challenging 2022.

However, analysis by JP Morgan's Doug Anmuth shows a bullish view of Farfetch, looking at it as a leading player in the $300bn luxury goods market with a proven e-concessions model, a strong position in China and a number of partnerships driving growth.

"We recognize that FTCH is a story that has yet to show itself in a good light," the analyst summarized, "but we believe the company continues to become a more valuable partner to the global luxury industry."

Anmuth reiterates an Overweight (Buy) rating with a $15 price target, which would imply a 174% upside for investors.

- How do you lb JPMorgan's picks? 🤔

Please note that this is not financial advice. Each investment must go through a thorough analysis.