Today, the world is constantly being pushed to switch to clean and green energy. We can see this, for example, with electric cars, where the market has literally exploded recently. So today we're going to take a look at 2 stocks that George Gianarikas believes could be winners in their respective fields.

Today, it's not just Tesla, but here in the Czech Republic we can see that perhaps all car companies are now switching to developing and producing electric vehicles. Even so, this is an industry that is still relatively new and is still developing and innovating. Elon Musk recently declared that lithium batteries are the new oil. In fact, oil is currently holding the economy together; it is, in short, something that is used in many industries, including the production of fuel for cars. Canaccord analyst George Gianarikas agrees with Musk.

We see many parallels between the communications revolution of the late 1990s and the new battery technology as a modern wildcat - an endeavor with high reward but not without risk.

Gianarikas dug into this market more, and picked 2 stocks that he believes could be potential winners in the lithium battery space. These are not only batteries for electric cars, but also for appliances, for example, and they can also be used in renewable energy.

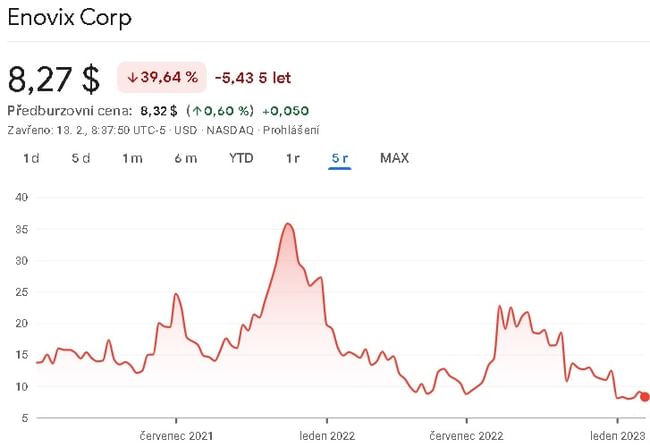

Enovix Corporation $ENVX

Enovix Corporation is a Silicon Valley-based technology company that develops and manufactures high-performance multi-cell lithium-ion batteries for a variety of applications, including electric vehicles, consumer electronics, and networked storage systems. The company was founded in 2012 and is headquartered in Fremont, California.

The company is known for its innovative use of 3 D silicon technology in its battery cells, which the company claims provides several advantages over traditional lithium-ion batteries, including higher energy density, improved safety and longer battery life.

The company has partnerships with several leading companies in the automotive and consumer electronics industries, and its battery technology has been recognized with several awards and patents. The company is backed by leading investors in the technology and energy sectors and is poised to play a significant role in the growing market for advanced energy storage solutions.

The company's strengths are as follows:

- Innovative Technology: The use of 3 D silicon technology in its battery cells differentiates it from other lithium-ion battery manufacturers and has the potential to provide several advantages over traditional batteries.

- Partnerships with leading companies.

- Support from leading investors: the company has received funding from several leading investors in the technology and energy sectors, providing it with financial stability and resources to further grow and develop its business.

Of course, everything is not always rosy, and the Company may have potential downsides. The main ones are as follows:

- Competition: The market for advanced energy storage solutions is becoming increasingly competitive, and Enovix will need to continue to innovate and differentiate its technology to stay ahead of its competitors.

- Scaling Challenges: Enovix's technology is still in the early stages of commercialization and scaling production to meet growing demand could present challenges for the company.

- Regulatory hurdles: The battery industry is heavily regulated and Enovix may face obstacles in obtaining the necessary certifications and approvals for its products in various markets.

The company has been publicly traded since 2020, so let's take a look at how the company fared in 2022. THE COMPANY'S FIRST 12 MONTHS OF TRADING HAVE SEEN THE COMPANY POST A 5.5 MILLION USD. In 2020 and 2021, the company reported no revenue. Of course, as a result, one would expect net income to be negative. For the past 12 months, the net loss was approximately $125 million. This is because this is a company that has been working on developing its products and is currently in a phase where it is trying to scale its products for mass production and distribution. At the same time, the company is rapidly increasing its research spending, which could boost its position among other players.

As far as the balance sheet is concerned, it shows relatively decent financial stability. The company has its liabilities well covered. It is even able to cover all of its liabilities with the money it has in its accounts. The net asset value here comes out to about USD 2 per share.

The company also, of course, has negative cash flow. In the case of operating cash flow, it is about -78 million. USD 78 over the last 12 months. In the case of free cash flow, it is about -121 million. USD. In both cases, this is another year-on-year decline. The company has quite a bit of growth in capital expenditures, which it is using to scale its mass production products.

Despite the fact that this is a very speculative stock, as the company hasn't even properly launched mass production yet, that fact hasn't diminished Gianirikas' optimism about the company.

Enovix brings a revolutionary architecture to battery design and manufacturing that has the potential to revolutionize the sector. The company has also amassed a strong sales funnel, endorsements from hefty industry players (e.g. Samsung) and seasoned management... the company now needs to prove it can produce its cells in volume and profitably. We believe it can and that this process will result in strong shareholder returns.

Along with Gianirikas, eight other analysts, including one from JP Morgan, share this optimistic view of the company. They agree on an average target price of around $20. per share.

Dragonfly Energy Holdings $DFLI

Dragonfly Energy is a company that specializes in the development of advanced lithium-ion batteries for a variety of applications. Lithium-ion batteries are widely used in consumer electronics, electric vehicles and renewable energy systems due to their high energy density, long cycle life and relatively low self-discharge rate.

The company aims to develop high-performance lithium-ion batteries that are safe, reliable and affordable. The company is dedicated to using cutting-edge materials and manufacturing techniques to produce batteries with superior performance and lower cost.

Company Benefits:

- High demand for advanced batteries: With the growth of the electric vehicle and renewable energy markets, there is a strong demand for high performance, reliable and cost-effective batteries.

- Focus on cutting-edge technologies: Companies that are dedicated to developing advanced technologies are often well positioned to gain market share and grow their business.

- Growing market for lithium-ion batteries: The market for lithium-ion batteries is expected to grow rapidly in the coming years due to the growth of electric vehicles and renewable energy systems.

Of course, as in the previous case, there are potential disadvantages that a company may run into. The main ones are:

- Competition: There are many companies in the market developing advanced lithium-ion batteries, so Dragonfly Energy will face competition in terms of price, performance and technology.

- High research and development costs: developing advanced lithium-ion batteries can be an expensive and time-consuming process that requires significant investment in research and development.

- Market uncertainties: The battery market is subject to changes in technology, regulations and consumer preferences, which can lead to uncertainties and challenges for companies in this sector.

This is also a company that is still in its infancy. It is now focusing on starting up regular mass production. Thus, the company has so far generated only minimal revenues. In the last 12 months, the company has not even generated any revenue. The company has also generated minimal net profit in 2020 and 2021. The last 12 months have been mostly loss making for the company.

The company's debt is almost three times higher than the company's equity. In the short term, the company has its current liabilities well covered by current assets. So in terms of debt, it is much worse off than the company mentioned above. In terms of net asset value, I'm looking at roughly $0.33 per share here.

In terms of cash flow, the company has minimal or even negative operating and free cash flow. Here again, the company is increasing its capital expenditures, precisely because of the introduction of mass production of its products. So, here too, this is a company that is in its infancy, and its eventual growth is yet to come.

Even though this is a rather speculative investment, Gianarikas believes in its bright future. What makes him so confident?

The company has established a strong foothold leading the traditional lead-acid markets into the li-ion era with its premium offering. We expect the company to continue to gain traction in the RV space and penetrate other markets, including marine, to drive growth. Longer term, Dragonfly's semiconductor capital efforts add an equity opportunity as the company seeks to evolve into a vertically integrated leader in energy storage markets. Dragonfly must now prove it can maintain its premium pricing, penetrate new verticals and make its solid-state offering a reality.

He and two other analysts who share a similar view have agreed on a target price of $14 per share.

Both companies are currently at an early stage where they may harbor great appreciation potential. But for me personally, it is too early to invest. This is an investment purely in vision and potential, which is not yet supported by anything. For me, there are too many factors that can fail. Will the company be able to successfully start production? Will these companies be able to produce their products profitably and in a way that is attractive to customers? And there are other questions that are currently unanswered.

Personally, if I wanted to invest in one of these companies, I would allocate a minimal portion of my portfolio to that investment. Personally, however, I like the vision of both companies, and they definitely deserve a place on my watchlist. The moment the companies move on, and for example have already successfully introduced mass production and sales of their products, I would reconsider the investment.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.

Sources:

https://finance.yahoo.com/news/lithium-batteries-oil-according-elon-003558965.html

https://www.marketwatch.com/investing/stock/dfli?mod=mw_quote_tab

https://www.marketwatch.com/investing/stock/envx?mod=search_symbol