Citi analyst Samuel Seow suggests that James Hardie Industries $JHX stock is still quite attractive, despite the company recently reporting weak results for the latest quarter.

James Hardie Industries $JHX is a global company that specializes in the production of building materials. Its products include fiber cement building materials such as tiles, flooring, roofing and piping. The company operates primarily in North America, Europe, Asia Pacific and is headquartered in Dublin, Ireland.

The company is best known for its cladding materials such as HardiePlank® and HardiePanel®. These products are characterized by high durability and longevity, which is important for homeowners and builders who want to invest in long-term quality construction.

- The company's focus on sustainability and reducing its environmental impact has also earned it recognition in the eyes of customers and the public.

Company Strengths 👇

The company focuses on developing and innovating cladding materials that are weatherproof, insect and mold resistant products. This enables it to offer high quality products that are durable and long lasting.

Furthermore, James Hardie Industries has access to cheap raw materials and can take advantage of efficient production methods, which allows it to offer its products at competitive prices. The company is well known and respected in the cladding materials industry. Its brand has become synonymous with quality and durability.

What does Citi analyst Samuel Seow say?

The weak Q3 result is a "buy signal" for $JHX stock. The downturn in the U.S. housing market has taken a toll on the building materials supplier, which is undervalued at the moment.

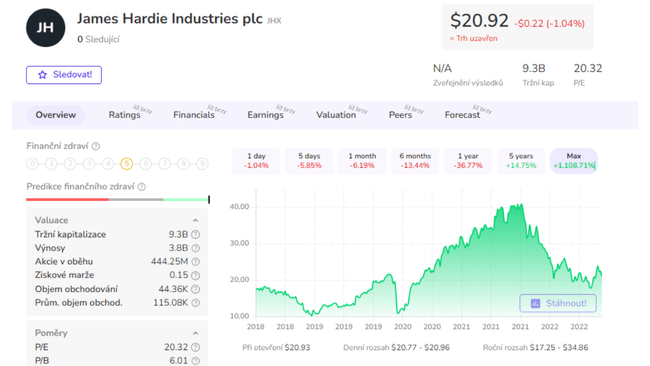

James Hardie reported a 4% decline in Q3 FY23 sales compared to Q3 FY22 and a 19% decline in adjusted earnings before interest and taxes (EBIT). The weak result prompted management to significantly lower its full-year FY23 guidance. The company now expects adjusted net income in the range of $600 million to $620 million. This is down from the previous estimate of USD 650 million to USD 710 million.

According to the report, Citi analyst Samuel Seow says the company is "attractive" and trades at a significant discount to long-term potential.

Seow said: After a weaker-than-expected result, we believe the market will be looking for the latest downgrade and we think this could be it. Ironically, we see the Q3 result as a buying event, but the outlook for total shareholder return should be positive.

- Seow gives a price target of $34.60 for JHX.

What did management say after the company's weak results?

CEO Aaron Erter also said the company sees the current period "as an opportunity." He said they are cutting costs while continuing to make "significant investments in strategic growth initiatives."

Erter commented: We have been able to rapidly and decisively accelerate our competitive advantage through this market downturn and we see this time as an opportunity. We remain aggressive and focused on profitable share growth in every region and segment in which we do business.

Please note that this is not a financial advisory business. Each investment must undergo a thorough analysis.