Last year was not at all successful for most investors. But Ken Griffin has nothing to complain about. His fund posted record performance, outperforming even the indices that were under pressure last year. Let's take a look at two stocks Griffin is confident in this year.

Ken Griffin is a billionaire hedge fund manager who is known for making some of the most profitable trades in the financial industry. Lately, Griffin has been betting big on two high-yielding dividend stocks. In this article, we'll take a closer look at these two stocks.

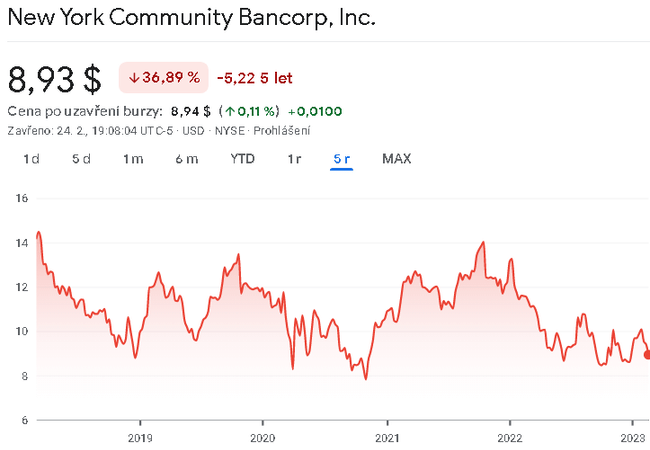

New York Community Bancorp $NYCB

New York Community Bancorp $NYCB is a bank holding company that provides banking services to customers in New York, New Jersey, Ohio, Florida and Arizona. The company specializes in single-family and commercial real estate lending and has a strong presence in the New York City metropolitan area. The company has a dividend yield of over 7%, making it an attractive investment for investors seeking income.

The company has a fairly well diversified portfolio, with operations in the following segments:

- Commercial Real Estate Lending: New York Community Bank is a leading lender in the multifamily and commercial real estate market, providing financing for properties such as apartment buildings, retail centers, and office buildings.

- Residential Mortgage Banking: the Bank offers residential mortgages to individuals for the purchase of homes or to refinance existing mortgages.

- Consumer Banking: This segment includes deposit products, consumer loans, and other banking services offered to individuals, such as checking and savings accounts, credit cards, and online banking.

- Wealth Management: New York Community Bank provides wealth management services to high net worth individuals, including investment management, financial planning, and trust services.

- Other: This segment includes various other banking services such as treasury management and merchant services.

The Company's business model focuses on providing banking services to local communities, particularly in the New York City area. Its primary business is lending to multifamily and commercial properties, which comprise a significant portion of its loan portfolio. In addition, the bank offers deposit products, consumer loans, and other services such as wealth management and online banking.

In terms of management, New York Community Bancorp is led by a team of seasoned executives with experience in banking and finance. Its CEO, Thomas R. Cangemi, has been with the company since 1990 and held various leadership roles before assuming his current position in 2021.

Benefits:

- Strong regional presence: New York Community Bancorp has a well-established presence in the New York metropolitan area, where it has a large customer base and a deep understanding of the local market.

- Real Estate Lending Focus: The company's focus on real estate lending has historically been a reliable source of revenue, as the New York City area is known for its high demand for multifamily and commercial properties.

- Experienced Management.

- Consistent dividend payments: the company has a track record of paying consistent dividends to its shareholders, which can be attractive to investors looking for income.

Disadvantages:

- Dependence on the property market: the company's heavy reliance on property lending means it is vulnerable to changes in the property market that could have a negative impact on its revenues and profits.

- Limited geographic diversification: New York Community Bancorp's operations are primarily concentrated in the New York metropolitan area, which means it is exposed to the economic conditions of that region.

- Regulatory Risk: As a bank, New York Community Bancorp is subject to extensive regulation that could increase its compliance costs and limit its ability to operate.

- Low Interest Rate Environment: A low interest rate environment can make it challenging for New York Community Bancorp to generate sufficient net interest income, which is a key source of income for banks. On the other hand, a high interest rate environment also makes it more difficult for the bank. In fact, demand for loans may be declining.

In terms of some basic company numbers, the company's interest income has grown by an average of about 5% per year over the past 5 years. Net interest income has grown at an average annual rate of about 7% over the last 5 years. Then in terms of total net income, it has grown at an average of about 11% per year. Net margins have trended upwards since 2020. But lately it looks like pressure from high interest rates is starting to put pressure on the company, with margins starting to decline from mid-2022. However, the company still maintains a relatively strong net margin of around 27%.

I was very surprised by the value of assets net of liabilities here, which came out to about $18 per share. That means that if investors buy the stock at $8, they're looking at net assets of $18 per share. So, if the company eventually goes bankrupt, even after paying all the liabilities that have priority, the shareholders would receive $18 per share. Of course, this value varies with the amount of the company's assets and liabilities. Well, given that the number of shares outstanding is more or less stagnant, I still took the average value of assets net of liabilities over the last 5 years, and here the value came out to about $15 per share.

Ken Griffin clearly sees this bankcorp as a sound investment, as his recent Q4 track record shows he bought in bulk. In fact, Griffin expanded his existing position in NYCB by more than 12.4 million shares - or a whopping 13,215%. His ownership stake in the company is now worth over $119 million. Griffin isn't the only one who is bullish on this stock. Along with him, 11 other analysts have looked at this stock recently, with 6 of those analysts concluding that this is a good buying opportunity.

We view key trends as favorable with strong organic loan and deposit growth, better-than-expected margin expansion, and stable credit quality. In addition, the company announced a material restructuring of Flagstar's mortgage business that should help improve its cost base and efficiency over time. Overall, we believe the outlook is reasonable, although dependent on the successful execution of the Flagstar integration and restructuring.

These analysts agreed on an average target price of $10 per share.

Personally, I like the company, and will most likely add it to my portfolio within the next week. It is a stable dividend company that currently offers a decent dividend yield. I also think the company is currently fairly well valued and offers a decent defensive cushion. Its dividends have been covered in the past as well. Overall, I like the company quite a bit, and the price doesn't look bad at first glance either.

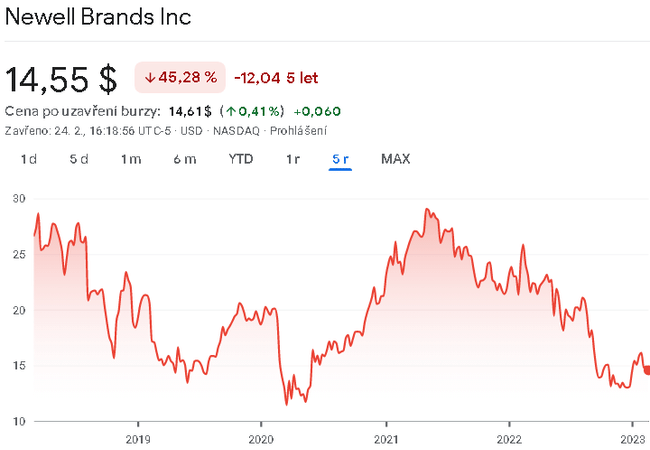

Newell Brands Inc. $NWL

Newell Brands Inc. is a consumer products company that designs, manufactures and distributes a range of consumer and commercial products globally. The company was founded in 1903 and is headquartered in Atlanta, Georgia, USA. The company has a dividend yield of around 6%.

The company's business model is primarily focused on providing innovative and high-quality products to its customers through a combination of organic growth and strategic acquisitions. Newell Brands operates in various business segments, including Food and Commercial, Home and Outdoor Living, Learning and Development, and Connected Home and Security.

- Food and Commercial: This segment includes food storage and home organization products, commercial cleaning and maintenance products and healthcare products.

- Home and Outdoor Living: This segment includes products for home organization, décor and appliances, as well as products for outdoor recreation such as refrigerators, grills and camping equipment.

- Learning and Development: This segment includes products for early childhood education, art and office supplies, and stationery.

- Connected Home and Security: This segment includes smart home and security products such as video doorbells, smart locks and home security systems.

The Company's diverse brand portfolio includes Rubbermaid, Sharpie, Paper Mate, Graco, Coleman, Contigo, Oster and Yankee Candle, among others. Newell Brands' broad range of products and brands enables it to meet a wide variety of consumer needs across multiple segments.

Benefits:

- Diverse portfolio of products and brands: Newell Brands has a wide range of products and brands that enable it to meet a wide range of consumer needs across different segments.

- Strong distribution network.

- Focus on innovation: Newell Brands has historically invested in research and development to create innovative products that meet evolving consumer needs.

- Experienced management team: The company's management team has extensive experience in the consumer products industry and is focused on improving operational efficiency and profitability.

Pros:

- Dependence on key customers: the Company is heavily dependent on a few key customers, which could negatively impact its earnings if these customers reduce their purchases or switch to competitors.

- Intense competition: The consumer goods industry is highly competitive and Newell Brands faces competition from both established companies and new entrants.

Being a relatively diverse company with a very diversified product portfolio, no huge growth is expected here either. The company's revenues have been more or less stagnant over the last 5 years, and the company shows only a minimal net profit. This is matched by stagnant net margins, which are slowly approaching zero. The average net margin in recent times could be around 5%.

Looking at the balance sheet, the company does not look that bad. The company has its current liabilities covered by its current assets, and the long-term debt-to-equity ratio here is about 1.5. Assets net of liabilities here come out to me at about $8 per share, which is considerably less than what the stock is currently trading for on the stock market.

Despite this, Griffin sees something very interesting about this company, as he had an open position in the stock and loaded up on an additional 2,285,158 shares in Q4. This expanded his NWL holding by over 300% and gave him a stake in the company of over $45 million. And Griffin is not alone in being positive about this stock. This stock has been looked at by 9 analysts recently, with 4 analysts agreeing that the company is an ideal buying opportunity, another 4 agreeing that it is a quality company, and 1 analyst thinking that it is not such a quality stock and that investors should rather sell it.

These analysts agree on an average target price of around $16 per share.

Personally, I don't like this company very much. The company has had very low margins for a long time, which causes the company's profitability to be low. This is such a hybrid company here that is stretched across different industries, which obviously takes a toll on the potential of this company. For me personally, this company is not exactly the best choice for investment at the moment.

Conclusion

Based on this selection, it looks like Griffin has chosen a more defensive path for this year, in the form of income generating companies for the portfolio. So it is safe to assume that even Griffin doesn't think we have won, and that we will see more pressure. Also, it's widely known that dividend stocks are more resilient in tough times.

WARNING: I am not a financial advisor, and this material does not serve as a financial or investment recommendation. The content of this material is purely informational.