Today, we're going to take a look at Owens Corning, a company known for its insulation and building materials. The company has been with us since 1938 and has been on the Fortune 500 list for 66 consecutive years, making it literally unique. But is it a good buy?

Basic company information

Owens Corning Corporation $OC is an American company based in Toledo, Ohio that specializes in the manufacture of insulation materials, composites, and other building and industrial products. Their main product areas are:

Insulation for Homes and Buildings - manufacturing thermal and acoustical insulation for walls, ceilings, attics and floors. Their main products include fiberglass and mineral fibers, which are used as insulation materials.

Composite Materials - Manufacture fiberglass and composite materials for industrial, construction and automotive applications. These materials are used in a wide range of industries such as aerospace, shipping, energy and other industries.

Building materials - manufacture roofing, facades and other building materials for homes and buildings. Their main products include asphalt and fiberglass roofing, which are used as a replacement for traditional roofing materials such as wood and metal.

Owens Corning is one of the largest manufacturers of insulation materials and composites in the world. The company focuses on developing and manufacturing environmentally friendly and energy-efficient products for homes and industrial applications.

- The company is one of the leading players in the global fiberglass market with a market share of about 20%.

- OC has approximately 100 facilities spread across North America, South America, Europe and Asia Pacific, with around 20,000 employees.

Owens Corning's strengths

Owens Corning is known for its investment in the development of new and better insulation materials and composites, which, combined with its wide range of products, makes for an exciting package.

Of course it's not just about quantity, quality comes first, the company uses quality manufacturing processes and materials, allowing it to produce durable products and meet stringent industry standards.

One of the company's great strengths is its strong brand - Owens Corning is a well-known brand in the market, which allows it to attract and retain customers, but also to promote its innovations, products and services well.

Let's take a look at the company's numbers 👇

Revenue

- 2017: $6.4 billion

- 2018: 7.1 billion USD

- 2019: 7.2 billion USD

- 2020: 7.1 billion USD

- 2021: USD 8.5 billion

- 2022: USD 9.8 billion

The average annual revenue growth rate over this period is about 9.2% per annum.

Net profit

- 2017: USD 289 million

- 2018: USD 545 million

- 2019: USD 405 million

- 2020: -$383 million (covid and demand issues)

- 2021: USD 995 million

- 2022: USD 1.2 billion

Owens Corning's average annual net income growth over this period is 52.52%.

Long-term debt

- 2017: USD 3,057bn

- 2018: USD 3 055bn

- 2019: USD 3 050bn

- 2020: USD 2 960bn

- 2021: USD 2 960 billion

- 2022: USD 2 992 billion

Average long-term debt declines by -0.44% on an annual basis

Assets

- 2017: USD 8.63bn

- 2018: USD 9.09bn

- 2019: USD 9.48bn

- 2020: USD 9.48bn

- 2021: USD 10.01bn

- 2022: USD 10,72 billion

The average annual growth in total assets is 4.46%.

Cash flow

- 2017: USD 614 million

- 2018: USD 681 million

- 2019: USD 612 million

- 2020: USD 880 million

- 2021: USD 1,176 million

Average annual growth over this period is 19.55%

Margins

Future plans

- The company plans to build a new plant in Russellville, Arkansas within the next two years. The factory will produce insulation materials for construction and industry.

- The company unveiled its growth strategy and financial targets for 2024, which include achieving annual sales of $10 billion with operating margins in the mid-teens percentages, maintaining an already reduced level of capital intensity between 4% and 5% of sales, generating free cash flow at or above 100% of adjusted net income over time

Outlook

The sector generally has good prospects for growth in the future. For example, the global fiberglass market is expected to grow from US$15.97 billion in 2021 to US$22.48 billion by 2029, at an average annual growth rate of 4.3%.

Similarly, the global glass composites market is estimated to grow from USD 99.91 billion in 2019 to USD 112 billion by 2027, at an average annual growth rate of 6.88%.

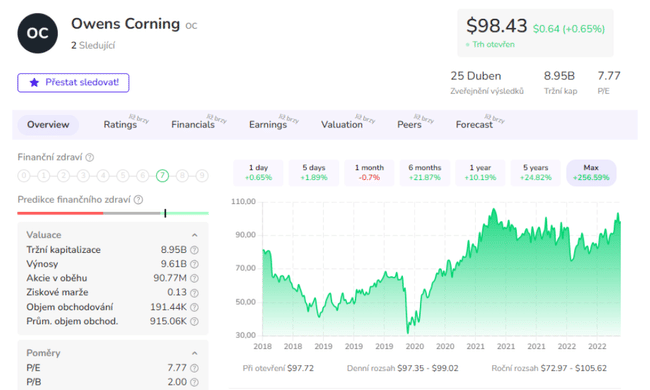

In terms of fundamentals, OC clearly has better numbers than the sector average, right off the bat for P/E, Forward P/E, P/S, P/FCFand Debt/Eq.

ROE = 27.4%

ROA = 11.7%

ROI = 17.7%

How's the dividend?

The annual dividend yield is 2.41% and the annual dividend payment is $2.08 per share. The company has been increasing dividends since 2015.

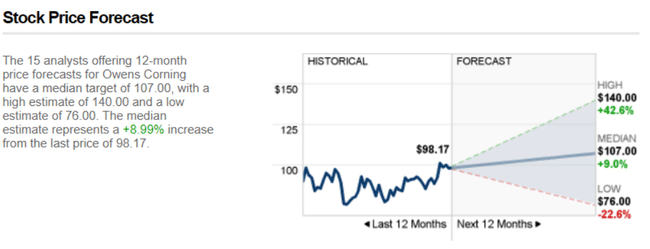

How do analysts see it?

What are the risks here?

In a way, OC could be considered a cyclical stock because it is dependent on demand for building materials, which is affected by economic cycles, but also on the raw materials needed to make its products - glass, asphalt and chemicals. Another potential risk is the increased frequency of acquisitions; of course, investors often like to see acquisitions, but if this trend continues, the company may begin to rapidly increase its debt to continue to fund this. According to the data, Owens Corning has made a total of 13 acquisitions, including 3 in the last 5 years.

Conclusion

Personally, I would not invest in OC at this time, the reason is simple, I am uncertain about the demand for building materials in this era where consumers are trying to save their money. Another reason is the recent insider sales, well, I would also like to see more stability in terms of net margins - at least a couple of years where it will hold at double digits. In the final analysis, I don't see much growth potential here in the near term (but maybe I'm wrong - email me how you see it).

Please note that this is not financial advice. Every investment must go through a thorough analysis.